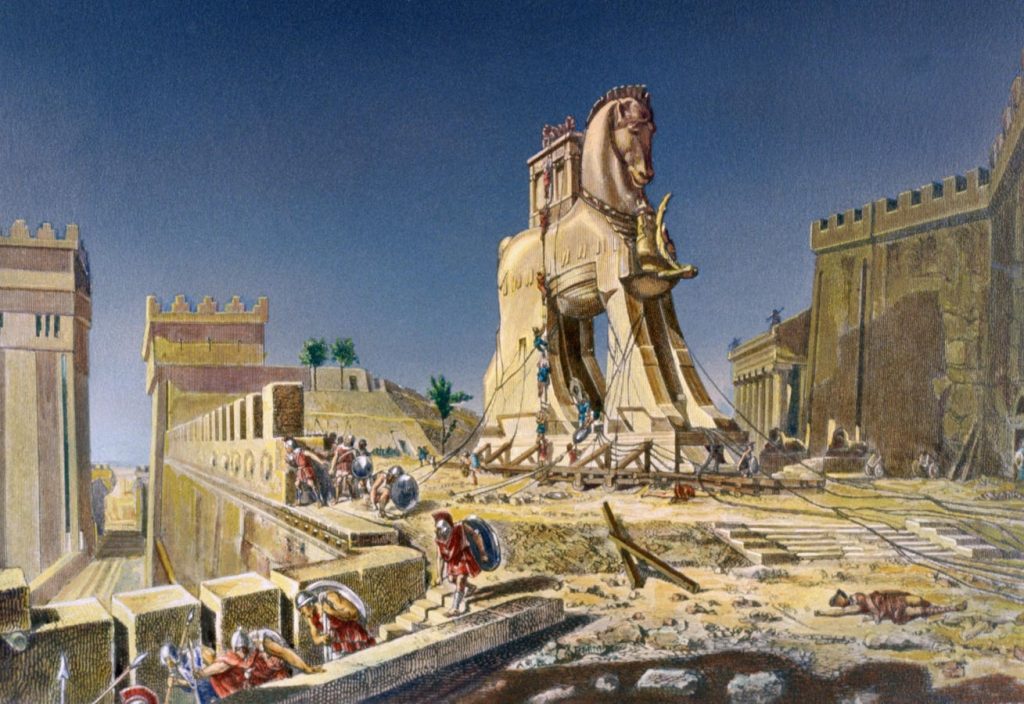

We’re all familiar with the story of the Trojan Horse. Washington politicians and bureaucrats routinely practice their own legislative and regulatory version of it. They simply apply a nice, innocuous name to new laws or burdensome rules that lead to more destructive government control or higher consumer costs, and then either try to pass them before anyone knows what’s going on or quietly slip them into unrelated “must pass” legislation.

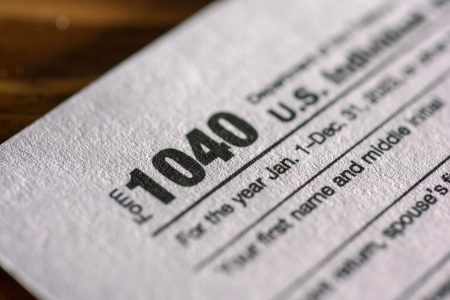

The Providing Reliable, Objective, Verifiable Emissions Intensity and Transparency Act (PROVE IT) is a perfect example. The PROVE IT Act may sound earnest and unobjectionable, but if passed it would set the stage for costly new and systemic carbon tariffs. In other words: new, expensive energy taxes. Ultimately, these would come in the form of future hidden taxes that would raise prices on everyday consumer goods and the businesses, big and small, that produce and sell them.

In terms of impact, future carbon tariff-linked energy taxes in the U.S. would be like the Valued Added Tax (VATs) other countries impose as supersized national sales taxes. European politicians especially love VATs because, unlike the transparent sales taxes in the U.S., VATs are embedded into retail prices instead of being applied at the final point of sale. In short, buyers (and voters) never directly see the taxes.

Policymakers should take note that the imposition of VATs in Europe is a significant reason growth rates there fell behind those of the U.S. starting in the 1970s. And voters should realize that VATs don’t replace other taxes—they’re price-hiking add-ons to existing taxes consumers are already paying. And make no mistake, the PROVE IT bill would be a first step on the road to imposing a VAT-type burden on American consumers.

As written, the PROVE IT Act directs the Department of Energy (DOE) to collect data on the emissions intensity for the domestic and global production of a range of products, including steel, cement, glass, aluminum, and more. Data from several designated countries, including the U.S., would be gathered, analyzed and stored by federal bureaucrats.

What’s the harm in collecting data? Well, first off, any such data-collection process is fraught with problems, not the least of which is the federal government’s increasing inability to keep Americans’ confidential data, well, confidential. Beyond the ramifications of potentially targeting political enemies, imagine if such proprietary data made its way to China, Russia or other global competitors.

Then there’s the process of even getting such detailed information about products and countries. It’s not like calculating the calories in a donut or a soft drink. Furthermore, does anyone believe that our competitors are simply going to hand over fully correct and verifiable information that may cause their domestic businesses economic harm? On a global scale, collecting this data would be beyond time-consuming, incomplete, manipulated and costly.

Proponents on the left argue that such a bill is a necessary, climate-focused means to reveal and monitor the level of greenhouse gas emissions released in the manufacturing of products in the U.S. and other countries. However, don’t be surprised when liberals in Washington quickly use such data as a steppingstone to later enact and expand costly VAT-like carbon taxes here under the progressive guise of saving the planet.

Meanwhile, a handful of GOP policymakers mistakenly claim the PROVE IT Act is a necessary data tool to protect large U.S. industries from foreign competitors. And despite promises to amend the bill to prevent its serving as a platform for new taxes, you can already hear the special interests pleading for tariffs based on selective data considerations. Hiding behind government-spun data and such words as “tariffs” won’t eliminate what these policymakers would be abetting: a costly, new national energy tax. And they shouldn’t think for a second that liberals won’t later work around any protective amendments to prevent the law from being used to enact a new tax.

The Great Depression taught us that trade wars and tariff-masked taxes can easily explode and lead to higher production costs, mass job losses and lower wages here at home. Sadly, those most impacted by a potential return to such failed policies and new taxes will be lower-income families, who already struggle to make ends meet.

In the wake of President Biden’s failed economic and energy agenda—and the resulting inflationary spikes in prices—do Washington politicians really believe that voters will be remotely supportive of policies like the PROVE IT Act, which could lead to massive new taxes, further increasing the sky-high costs of daily goods and services? Don’t bet on it!

Read the full article here