Key takeaways

- Student credit cards are typically easier to qualify for and offer helpful rewards and perks related to students’ lifestyles.

- Federal law requires cardholders to be at least 18 in order to qualify for a card, but the proof-of-income requirements at that age are steep. Restrictions loosen considerably when a person turns 21.

- When choosing the best student card for you, take into account your spending, whether you plan to study abroad and the credit range required for approval.

- Know that you can also become an authorized user on someone else’s account, apply for a secured credit card or look into cards designed for those with no credit history.

Whether you’re heading off to college for the first time or returning for another school year, getting a student credit card could help you reach some of your financial goals, especially as they relate to building credit. Cultivating consistent, positive credit-building habits with a student credit card that fits your needs will set you on the right track for future financial success.

But before you apply for just any card, you’ll need to consider a few factors to help you pick the right one. Learning how to choose a credit card for college students doesn’t have to be hard. We’ll give you the tools and step-by-step guidance to help you choose a student card that fits your needs.

Make sure you meet the eligibility requirements for student credit cards

You won’t have to worry too much about your credit score before applying for your student credit card. That’s because the credit requirements for approval are more relaxed to account for the typical student’s lack of credit history. Most of the time there’s no minimum credit requirement to stress over with student cards.

The minimum age to get a credit card is 18 years old, but that comes with a few stipulations thanks to the Credit CARD Act of 2009. If you’re under 21 and applying for a credit card, you’ll need to provide proof of consistent income to qualify.

The good news is that more than you may expect could qualify as income, including regular wages from your on-campus job, consistent allowances from a parent or even funds from scholarships or financial aid that are leftover after meeting your education needs.

If you don’t have independent income, you can still access credit before 21 by becoming an authorized user on someone else’s card.

Applying for credit after you hit 21 releases you from some of the stricter parameters of the CARD Act, but you’ll still be required to note a few important pieces of information on your credit card application. Be ready to provide the following information:

Analyze your spending habits

Understanding where your money gets spent isn’t just a smart budget move. It can also help you choose a student credit card that earns rewards on purchases you’re already making. What sets student cards apart is their focus on student-related perks and benefits. If you’re an adventurous student, you could find a card that rewards you for gas and airfare. Leaning more toward practicality? Look for cards that offer cash back on groceries.

Keep in mind: If a student card offers rewards, these rewards are usually generous in spending categories that are popular among students, like dining, entertainment and Amazon purchases.

Recent college graduate, Daniel Kelton shared his experience of using a student credit card to earn rewards and build credit while he was in college. After a year of using his student credit card, he earned over $400 in cash back.

“I started paying for all my groceries and gas on the card. And I paid it off every month so I wasn’t racking up interest payments…Now that I’ve got a credit history built, I’m looking to transition into a card with more rewards.”

— Daniel Kelton, recent college graduate

When you’re not sure what your spending habits are, it’s time to consult your bank account. Most banks have budgeting tools built into your online banking to help you break down which categories you’re spending the most in each month. If your bank doesn’t have those tools, you can always use a budgeting app or a spreadsheet to organize your expenses.

Then, check out Bankrate’s Credit Card Spender Type Tool to see what kind of spender profile best suits you. Once you’ve chosen a profile, you can get personalized credit card recommendations based on your spending habits and daily needs.

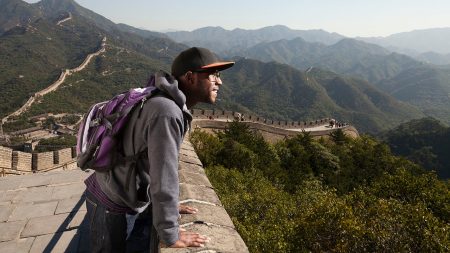

Consider whether you’ll study abroad or travel often

Because of the extra processing expenses, many credit cards charge fees on purchases made outside of the U.S. — usually around 3 to 5 percent of each transaction. That quickly gets expensive if you’re planning to study abroad or travel overseas while you’re in college.

Typically, student credit cards are affordable to hold since they’re often free of charges like annual fees and foreign transaction fees. This feature is ideal for students who plan to study abroad and prefer to pay with plastic instead of carrying cash. Using a credit card is a safe and secure way to make purchases overseas, and picking a card that doesn’t charge foreign transaction fees can save you money in the long run.

You’ll also want to think about how widely accepted your credit card will be while abroad. Some credit card issuers use networks like Visa that are internationally available nearly anywhere, while others might use a network like American Express that has a slightly more limited range of use.

Think about the effort you’re willing to put into keeping up with your credit card

Getting a credit card in college is a wise decision to build your credit when used responsibly. And earning rewards is an added benefit. But overcomplicated credit card rewards are the last thing you’ll want to deal with when you’re balancing studies, friends and even Greek life.

When choosing a student credit card, start with one that has a simple rewards structure and doesn’t require much effort to keep up with outside of the required monthly payments. Flat-rate cash back credit cards are one of the simplest rewards cards to begin your journey with. You’ll earn the same rate of cash back on every purchase rather than keeping up with complex spending requirements or rewards systems.

Once you get the hang of it, you can take it to the next level by choosing a student credit card with rotating bonus categories or even a travel credit card that rewards you in points or miles. Both options can be worthwhile, but you’ll need to decide which one is most feasible for your lifestyle.

Check out alternatives to student credit cards before you apply for one

Getting a student credit card isn’t the only way to earn rewards, build credit or pay for purchases while you’re in college. These alternatives still let you access credit and gain similar benefits to student credit cards:

- Become an authorized user: If you’re under the age of 18 or don’t feel ready to take on the full responsibility of being a primary cardholder on a credit card, you could become an authorized user on someone else’s credit account (usually a parent or guardian). Assuming you and the primary cardholder both use the card responsibly, you’ll build credit and start to create healthy financial habits.

- Sign up for a secured credit card: Another common starting point for people looking to build credit in college is a secured credit card. These cards require a refundable security deposit, which serves as collateral for a card issuer just in case you’re unable to pay your bill.

- Look into credit cards for no credit history: Also known as starter cards, these credit cards are built for those with little or no credit history, a category many students fall into. The credit requirements for approval are low, and some are even geared toward students.

Narrow down your choices by comparing cards

You’ve nailed down your spending habits, you know what features to prioritize, and what kinds of rewards you want to earn. Now it’s time to narrow down your options by comparing cards. Here are the other factors you’ll need to compare when choosing a student credit card:

Credit card terms to know

- Annual percentage rates (APRs):

- There are a few types of APRs when it comes to credit cards, but the main one that gets advertised is typically the purchase APR. Officially, this is the interest rate you’ll pay yearly to carry a balance on purchases. Practically, you’ll see this add up month-to-month on your card statement. The lower the APR, the better. Otherwise, you could find yourself paying a ton of money in interest fees if you have to carry a balance.

- Fees:

- These can include late fees, foreign transaction fees or other penalty fees. Some cards will waive the late fee for the first missed payment, while others will charge you right away, so it’s important to be aware of not only the fee amount, but also the rules regarding them.

- Rewards rates:

- Now that you know your spending habits, you can compare cards that offer rewards in certain spending categories. You can also figure out whether a rotating category card or a flat-rate rewards card might be better for your needs.

- Additional perks:

- Most student credit cards are pretty lean on extra perks, but they’re still worth looking into. Most cards offer welcome bonuses, and some offer other benefits like complimentary Uber One memberships, 0 percent introductory APR offers and more.

Find out which cards you qualify for

Most student credit cards don’t have the same credit requirements as regular cards. Since they know most students have no credit or limited credit, you typically won’t have to be concerned with fitting into a credit score range. However, any parent or guardian acting as your cosigner will still have to meet the card issuer’s approval requirements.

To avoid wasting your time, stick to cards with approval requirements that fall within your credit score range or don’t require a credit history to apply.

Credit Tip:

Don’t know your credit score yet? There are a few ways to check your credit score for free.

After finding your credit score and creating your shortlist of credit card choices, take the next step of getting prequalified or preapproved for the cards you want. The prequalification and preapproval process includes a soft pull on your credit report, which won’t impact your credit score. By looking at your report and other factors, an issuer can let you know whether you’re likely to be approved for the card you’re looking at.

You can check to see whether you’re preapproved by going directly to the issuer’s site or by using Bankrate’s CardMatch tool. Once you know your approval odds, you can make an informed decision about which card to apply to.

Keep in mind: Getting prequalified or preapproved for a credit card does not guarantee full approval. You’ll still have to go through the application and wait for the issuer’s final say.

The bottom line

Getting a student credit card is a big step in your financial journey. As a student, choosing the right card is a solid way to start building your credit with responsible use. Do thorough research on the best student cards on the market and pick one that will best fit your lifestyle and reward the type of spending you do the most.

Make sure you have all the necessary materials for a successful application, and always pay your bill on time once you’re approved. You’ll be on your way to an upgrade and a great credit score in no time.

Read the full article here