Taxes

Soon after the 2024 elections results rolled in, the speculation began about what they might mean—especially when it comes to…

Almost every legal settlement includes a full release of claims. A release may recite some of the plaintiff’s claims, but…

While federal tax questions have dominated the headlines this election cycle, state and local taxes can significantly impact individuals and…

Halloween spending is expected to reach $11.6 billion in 2024, just shy of last year’s record-breaking spooky season—that works out…

Even though tax returns on extension were filed just a few days ago, the IRS is already thinking about the…

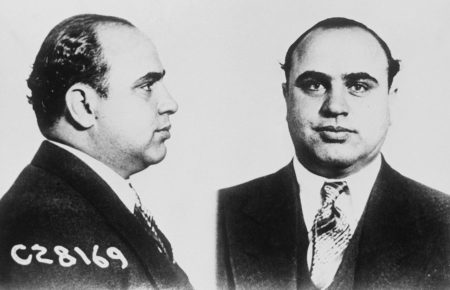

On this day in 1931, Al Capone was found guilty of tax evasion. The gangster, who had reportedly boasted, “They…

The U.S. Department of the Treasury and the IRS have announced that the number of states offering Direct File will…

The IRS is not backing down on efforts to stem the tide of what it believes to be erroneous or…

The Corporate Transparency Act—or CTA—requires reporting companies to file reports with the Financial Crimes Enforcement Network (FinCEN). The deadline for…

The European Union’s top court has issued a final ruling in an ongoing legal battle over tax benefits, finding that…

Vice President Kamala Harris has proposed a 28% tax on long-term capital gains for Americans who earn $1 million or…

The U.S. Bureau of Labor Statistics reported that the consumer price index (CPI) increased by 0.2% on a seasonally adjusted…