You know that feeling you get when you find $20 in your pocket? Imagine finding $500!

And if you can find that kind of money without cutting the budget, that’s even better! So what’s the trick? It’s quick and easy—all you have to do is take a look at your insurance policies. And while that may not sound like a fun way to spend an afternoon, you might be surprised by how much you can save.

Old Policies Could Cost You

When it comes to insurance, most people like to set it and forget it. A recent survey showed that only a fraction of drivers (22%) have switched policies in the past five years—and many stay with their insurance companies for a lot longer.1 In that amount of time, your insurance needs can change. But we keep those old policies, believing our loyalty is earning us a discount.

Phil H. found out that wasn’t true when he finally took a good look at his home and auto insurance. He and his wife had used the same insurance company for more than 20 years, until he consulted an independent insurance agent for home comparison quotes.

“Our agent helped us save $600 per year on our home and auto insurance,” Phil told us. “That savings will go to our debt snowball—we’re almost there!”

Phil’s agent was able to find him a better deal because independent agents aren’t tied to one insurance company. They’re able to shop and compare policies from several companies to find the right coverage at the best price.

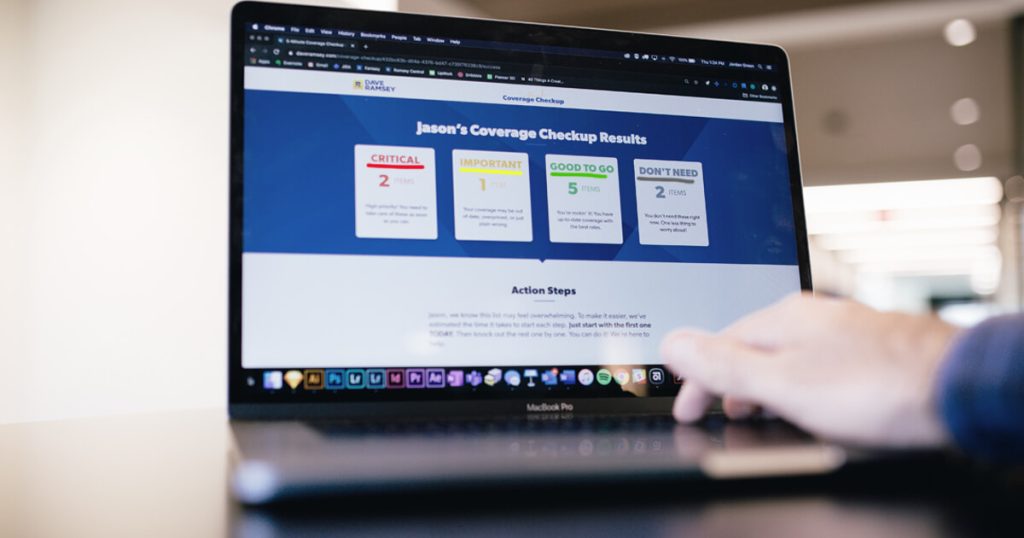

And if you’re not sure what you should keep, what to increase, and what to drop in coverage, take our 5-minute coverage checkup to make sure you have what you need.

Big Names Could Mean Big Bucks

The biggest companies in the insurance industry pour billions of dollars into advertising to build that name recognition among potential customers.2 That’s how big companies convince many insurance customers that they offer lower prices and more convenience.

But those who buy their insurance directly from the big guys soon have a change of heart. In fact, clients of our Endorsed Local Providers (ELPs) are much happier with their coverage and often get a better price. That’s probably why 69% of folks who shopped around with an agent plan on using one again in the future.3

Michael H. knows he got a better price: “I saved 43% on my homeowner’s policy and 38% on my auto [insurance]. And both policies provided better coverage.”

Michael and his family will save $700 a year on their coverage, and all it took was one phone call.

Read the full article here