Key takeaways

- The Capital One SavorOne Cash Rewards Credit Card offers cash back rewards in key bonus categories, including groceries, dining, entertainment and streaming services.

- This card also includes no foreign transaction fees, making it a great card to use when traveling abroad.

- New cardholders can also earn a welcome offer of $200 after spending $500 within three months, which is easier to earn than other bonus offers.

There’s something you should know about me: I’m a cash back maximizer. I label each of my credit cards with its cash back category percentages, and I even have a cheat sheet in my wallet that highlights the best card for any type of purchase.

If you were to take a look at my cheat sheet, you’d see that I reach for my Capital One SavorOne Cash Rewards Credit Card whenever I pay for dining, streaming services, grocery store shopping or foreign purchases. Here’s why.

What to love about the Capital One SavorOne Cash Rewards

Dining out pays off

As a marketing consultant who primarily works with the restaurant industry, dining out is part of my job. The SavorOne card helps me get more out of my dining expenses with its unlimited 3 percent cash back on dining. (Note that the SavorOne also offers 10 percent cash back on Uber and Uber Eats purchases through Nov. 14, 2024.)

Whether I’m evaluating a restaurant’s outdoor dining setup, testing contactless ordering and payments technologies or comparing online ordering platforms, the SavorOne rewards me for doing my job and stimulating the economy.

While other credit cards may offer higher rewards rates on dining and groceries, the SavorOne’s lack of annual fees is hard to beat. Bankrate’s lead credit cards writer Ana Staples even canceled her American Express® Gold Card to get the Capital One SavorOne. The Amex Gold earns 4X points on restaurant (including takeout and delivery in the U.S.) and U.S. supermarket purchases (on up to $25,000 in supermarket purchases per year, then 1X points) — but it also charges a $250 annual fee.

“I mostly cook at home these days and spend about $6,000 per year on food,” Ana says. “That gives me $180 in annual cash back on my SavorOne. With the Amex Gold, I’d earn 24,000 Membership Rewards points worth $240 when redeemed for airfare with Amex Travel. That doesn’t even cover the $250 annual fee.”

Rewards for having fun

The SavorOne gives me an unlimited 3 percent cash back on entertainment (along with 8 percent cash back on Capital One Entertainment purchases), which includes ticket purchases for things like tourist attractions, movie theaters, concerts and more. During the pandemic, this perk came in handy when buying tickets for virtual events, but these days I use it when I visit museums, attend shows and see films on the silver screen.

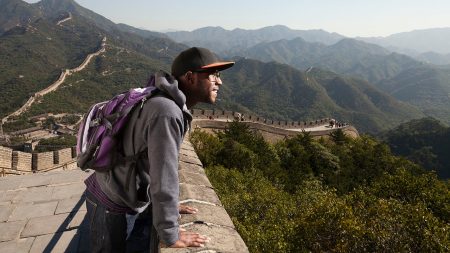

No foreign transaction fees

Instead of binge-watching the latest TV show or learning TikTok dance routines, my guilty pleasure is online shopping. While my Bank of America® Customized Cash Rewards credit card is my go-to card for online shopping, it charges a 3 percent foreign transaction fee, which annuls any cash back I earn buying from overseas merchants. So whenever I shop with a company that’s based abroad, I use my SavorOne card because it has no foreign transaction fees.

It’s not always easy to find a card without a foreign transaction fee and no annual fee. Plus, it rewards me for the type of purchases I make most often when I’m on vacation: dining and tourist attractions.

Perks for grocery stores and streaming services

I was already pretty passionate about my SavorOne card before Capital One expanded SavorOne’s cash back offerings several years ago. The card currently offers 3 percent cash back on popular streaming services and grocery store purchases (excluding superstores like Walmart and Target). Previously, the rewards rate was 1 percent for streaming services and 2 percent for grocery store purchases.

Now, this is the only credit card I use at grocery stores. That translates to about $140 in cash back for my annual grocery store bill as a single adult. If you have a lot of mouths to feed, you could earn a significant amount of cash back for your grocery store purchases.

And now that the SavorOne gives me 3 percent cash back on streaming services, I earn some money from my Netflix bill. Note that a few popular streaming services are excluded, including Prime Video. While this cash back translates to only about $5 in cash back each year for me, I feel good knowing that I’m optimizing every purchase.

Attainable welcome offer and attractive referral bonus

New cardholders can take advantage of a $200 cash bonus after spending $500 within three months of opening the account. Unlike some credit cards, which have a difficult-to-reach spending threshold for their welcome offers, the SavorOne’s threshold is much more attainable.

If, like me, you’ve had the SavorOne card for a while and have already redeemed your welcome offer, you can also earn extra cash back by referring friends to the card. You’ll typically receive a cash bonus for each person who opens a SavorOne card through your unique referral link. However, note that the specific referral bonus you’ll get is based on the product you have. You can sign in to your account to see if you’re eligible for a referral bonus offer.

The bottom line

I love the Capital One SavorOne Cash Rewards because it rewards me for some of life’s pleasures like dining out, entertainment and watching Netflix, as well as mundane necessities like getting groceries. It also comes in handy by saving me money on foreign transaction fees when I shop or travel abroad. These are just some of the reasons the SavorOne card will be a staple in my wallet for years to come.

Information about the Bank of America® Customized Cash Rewards credit card was last updated on July 1, 2024.

Read the full article here