Apple shares rose to a record high during Monday’s trading session after Morgan Stanley designated the stock as a “top pick” due to the company’s artificial intelligence (AI) push to boost device sales.

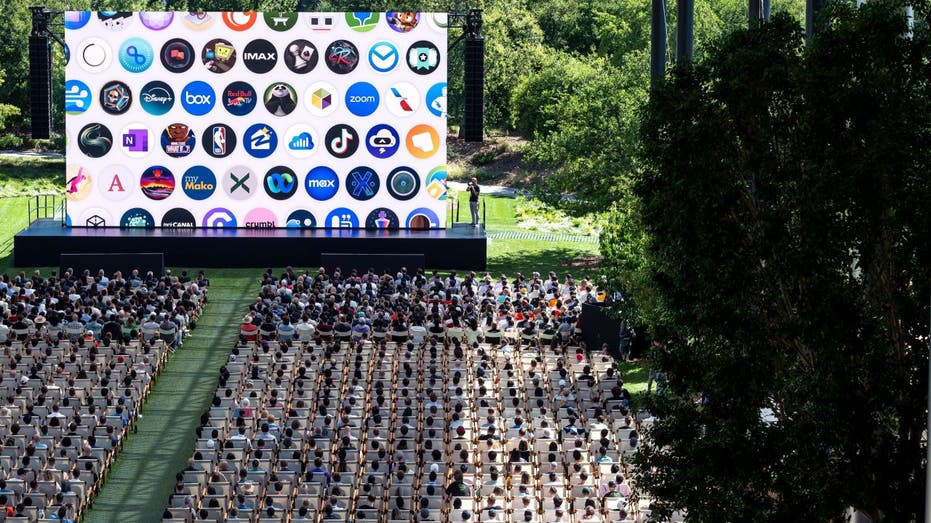

Last month, Apple unveiled Apple Intelligence as a way to encourage customers to upgrade their devices to the latest models that have the new built-in AI functionality. The move came as Apple was seen as lagging behind Alphabet’s Google and Microsoft-backed OpenAI in the AI race.

Apple shares reached $236.30 during Monday morning trading to give the company a market value of $3.62 trillion, the highest in the world. Although it has since pared back some of those gains, Apple’s stock was up over 1.9% and trading around $235 a share as of early afternoon.

“Apple Intelligence is a clear catalyst to boost iPhone and iPad shipments,” Morgan Stanley analysts wrote.

APPLE TOPS MICROSOFT, REGAINS TITLE OF WORLD’S MOST VALUABLE COMPANY

The new Apple Intelligence technology is compatible with only 8% of iPhone and iPad devices and Apple currently has 1.3 billion units of smartphones in use by customers, the analysts noted.

They added that Apple could sell nearly 500 million iPhones over the next two years. The firm previously expected Apple to sell between 230 million and 235 million iPhones annually over the next two years and raised its price target to $273 from $216 based on the new projections.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AAPL | APPLE INC. | 234.40 | +3.86 | +1.67% |

Apple stock has risen more than 26% year to date and over 8% in the last month. It has an average rating of “buy” with a median price target of $217, having outperformed the S&P 500 index this year, according to LSEG data.

WHAT IS ARTIFICIAL INTELLIGENCE (AI)?

Industry analysts expect Samsung and Apple to lead a global smartphone market recovery this year amid the buzz around generative AI-enabled smartphones.

Apple sold 45.2 million smartphones globally in the three months ending in June, up from 44.5 million a year ago, although its market share fell to 15.8% from 16.6% in the same period, according to IDC data.

Reuters contributed to this report.

Read the full article here