I’ve previously written about Employee Retention Credit (often called the ERC or ERTC) refund claims pending with the IRS here. I’ve also previously shared thoughts for small businesses who, tired of waiting for the IRS to process their ERC refund claims, are considering suing the IRS for their refunds. The IRS recently upped the ante, however, in a press release that said (among other things) that the IRS would soon proactively deny tens of thousands of purportedly “high risk” ERC refund claims. True to its word, the IRS began denying those claims in mid-July.

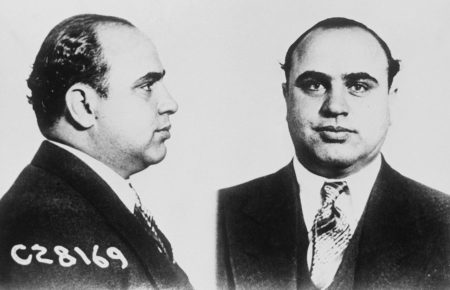

If the IRS denied your ERC refund claim, your options will depend on your situation. Let’s get the worst-case scenario out of the way first. If you claimed the ERC for a nonexistent business or employees, or based a claim on other patently false pretenses, you might want to consult with criminal tax counsel, although a denial of a claim without a tax loss probably would not be a very appealing case for overworked investigators or prosecutors. If, however, you filed multiple false claims, some of which caused the IRS to issue refunds (possibly creating a tax loss), but others of which the IRS is now denying, you should definitely consult with criminal tax counsel as soon as possible, as that would be a far more appealing case for the government to pursue, and it will not be hard for the IRS to connect the dots.

Appealing vs. Suing

Now let’s turn to those readers who believe they are entitled to the ERC – or at least have a good argument for it – but who received denial letters. If you believe that you are, or may be, entitled to the refund, you have two primary options. The first is to ask the IRS Independent Office of Appeals (IOA) to review the IRS’ denial of your claim. Unfortunately, some of the IRS’ ERC denial letters did not inform the recipient of the right to contest the denial at the IOA. The IRS has since acknowledged that some of the letters “inadvertently omitted a paragraph highlighting the process for filing an appeal.” I spoke with Justin Elanjian, a managing director at Stout who works in the Disputes, Claims, & Investigations group and who spends much of his time on ERC-related matters about this. He told me that “whether appealing the denial is an option explicitly stated in the letter, a taxpayer has the right to appeal. Many taxpayers that do not have representation or cannot afford it will be seemingly unaware of their options for remedy.” To contest the IRS’ denial in the IOA you will need to timely file a “protest letter” with the IOA that explains why the IRS erred in denying your refund claim. You should submit your protest within 30 days of the date of the denial letter. The IRS website contains other important information about what must be included in the protest letter.

The second option is to file a tax refund suit against the government. My personal view is that it usually makes more sense to protest an IRS denial with the IOA first, as that gives you two bites of the apple. If the IOA approves your refund claim, you have what you want. If the IOA does not approve your refund, you can then sue in court. Note, however, that you must file suit within two years of the date that the IRS denied your refund, unless you and the IRS agree to extend that deadline, regardless of whether the IOA has completed its review of your case or you will lose your opportunity to sue in court. As noted above, I’ve previously shared a checklist of things to consider before you file a refund suit for those who are still waiting on the IRS to process their claims, and that same list applies if you would prefer to bypass the IOA and pursue your refund in court in response to a denial letter.

FOIA Requests

There are a couple of actions you should consider if the IRS denied your ERC refund claim in error. First, you should consider requesting your administrative file from the IRS. I spoke with former IRS Commissioner Chuck Rettig, now a shareholder practicing tax law at the law firm Chamberlain Hrdlicka, and he advised that “if an IRS letter of denial is received regarding an ERC claim, consider submitting a FOIA [Freedom of Information Act] request for the entire administrative file pertaining to the claim and denial, including any and all related electronic communications, etc. If in doubt, there is information on IRS.gov regarding submitting a FOIA.” (Full disclosure – I also am a shareholder at Chamberlain Hrdlicka.)

Notably, the IOA is required to provide certain taxpayers who request their files with “access to the nonprivileged portions of the case file on record regarding the disputed issues (other than documents provided by the taxpayer to the Internal Revenue Service) not later than 10 days before the date of such conference.” For this to apply, a business’ gross receipts must not exceed $5 million for the taxable year to which the dispute relates (the rules are different for natural persons). If you cannot fit within that requirement, you can always request your files through the more formal FOIA procedures, as Rettig noted.

Recovering Fees and Costs

Second, you should consider whether you are eligible to recover from the government some of the fees and costs you expend in contesting the erroneous determination. Unfortunately, one of the requirements for a business entity to obtain a fee award is that it must be worth less than $7 million at the time of filing the contest, so not everyone will be eligible to recover fees. And even if you are eligible to recover fees and costs, the rates that the government is required to pay are often less than the market rate for good tax counsel. You also have to exhaust your administrative remedies before going to court, which means you must first protest the claim denial to the IOA (assuming the IRS gave you that option) before taking your case to court. Finally, the IRS’ rule is that fees for costs incurred in appealing a denial to the IOA are only recoverable to the extent that such fees were incurred after the IOA renders a decision, which means that such fees will only be recoverable in rare situations. Still, a fee award can definitely be worth pursuing as it can defray your cost of representation, so if you meet the net worth test, it would be prudent to keep careful track of your fees and costs.

With all that said, I don’t want readers to get their hopes up. It is usually very difficult to get a fee award from the IRS because you usually have to show that the IRS’ position was not “substantially justified.” (I wrote “usually” because another option is to submit a “qualified offer,” but that is a complicated process that I would not recommend unless you are represented by counsel.) The “substantially justified” test can be a high bar which often prohibits taxpayers from getting reimbursed.

Silver Linings

ERC refund cases may be an exception, though, as I’ve seen early indications that at least some of the IRS’ denial letters do not appear to be substantially justified. For example, many of the denial letters that I’ve seen deny claims because the claimant was not operating a trade or business. The problem is that the IRS issued the denial letters without first asking the recipients for information, and it appears that some of the recipients were operating a trade or business. Elanjian from Stout shared other examples of possibly improvident IRS denial letters: “We’ve seen letters that include an amount of the credit claimed for the period at issue that materially differs from the amount of the original claim. We’ve also seen claims denied because only employers which are recovery startup businesses are eligible for the period to which the claim relates, yet the taxpayer’s Form 941-X clearly indicated that they are in fact a recovery startup business.” I don’t think the IRS is going to be able to show that its position was substantially justified when it is dead wrong and the IRS did not bother to ask the taxpayer for more information.

Another silver lining may be that if the IRS cited an obviously incorrect reason for denying the ERC, you may have an easy time convincing the IOA to cause the IRS to issue your refund – in other words, this may actually get you your refund faster. Indeed, IOA policy is to preclude the IRS from raising “new issues” at the IOA. So even if there were some other reason that the IRS might have to deny your claim, but the IRS did not rely on it, the IOA should not allow the IRS to present those reasons for the first time at the IOA.

Unfortunately, eligibility for the ERC is not always clear. In particular, claims based on the partial suspension/government order test are particularly subjective. Another important issue to keep in mind, which I have also previously written about, is that some of the IRS’ guidance on the ERC is arguably more restrictive than Congress intended. In other words, you might be eligible for the ERC under the statute (which always takes priority) even if your claim does not comply with IRS guidance. These issues are complicated. If the claim is big enough, it may make sense to hire counsel to represent you in such cases, even at the IOA and certainly in court.

Tom Cullinan, a shareholder in Chamberlain Hrdlicka’s Atlanta office, served as Counselor to the IRS Commissioner from 2018 to 2022, from 2018 to 2022 and acting IRS Chief of Staff for nine months in 2022.

Follow me on LinkedIn.

Read the full article here