Key takeaways

- Points and miles, as well as benefits like free hotel stays, statement credits and lounge access, can make a travel credit card worth the annual fee.

- People who travel often, spend a lot or are small business owners might get the most out of a travel card.

- It’s important to pay off the balance on a travel card, as any interest you accrue will outweigh the value of your rewards.

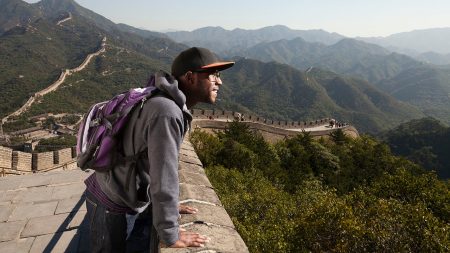

The best travel rewards credit cards appeal to frequent travelers with the points and miles you can earn on everyday spending to put toward your next trip. Influencers have even taken to social media to show off travel experiences purchased with points or miles. And when you consider the extra perks that come with the cards, it might make sense for a travel card to be part of your travel toolkit.

Still, despite the popularity of travel cards, they’re not for everyone. Many travel rewards cards have high annual fees and benefits that may be hard to maximize depending on how you travel.

The most valuable travel card perks ultimately depend on your typical travel habits and personal preferences.

— Garrett Yarbrough, Bankrate credit cards writer and reviewer

Learn more about how to determine whether a travel credit card might be right for you.

Most valuable travel card benefits

Ideally, a travel card’s rewards and benefits would make up for the annual fee.

“A premium card may carry hundreds of dollars worth of annual credits and travel perks, but these perks are worthless if you can’t take advantage of them — or they take more effort to utilize than it’s personally worth to you,” Yarbrough explains.

He continues: “For instance, a complimentary Delta Companion Certificate is one of the most coveted travel perks and could be worth hundreds of dollars in airfare. However, it’s worth $0 if you never fly with Delta or another person.”

After years of reviewing and using credit cards, Yarbrough recommends looking for cards with complimentary airport lounge memberships, travel credits, travel insurance and expedited airport security screening service credits.

Here’s a look at the most valuable travel card benefits.

Travel card benefits

- Points or miles rewards

- Welcome bonus

- Airport lounge access

- Travel insurance

- Global Entry or TSA PreCheck credit

- Statement credits

- Free nights at hotels

- Companion passes

- Elite status

Points or miles rewards

The main idea of a travel credit card is that you earn points or miles on purchases you make with the card. You can use these rewards to book flights, hotels and rental cars. Travel cards usually offer a higher earn rate on travel purchases, especially when booking through the issuer’s travel portal.

Points or miles are generally worth the most when redeemed with the issuer’s best transfer partners. They may be worth the least when redeemed for non-travel purchases.

Welcome bonus

The best way to maximize a travel card’s value right off the bat is to earn the welcome, or sign-up, bonus. After being approved for the card, there may be a minimum spending requirement in the first few months to earn a large chunk of points or miles.

Some savvy cardholders earn and use that welcome bonus to pay for their next vacation. Just remember that no rewards are worth overspending and going into debt. But you can plan to redirect certain expenses to the new card or make a big pre-planned purchase during that time frame.

Airport lounge access

Many premium travel cards come with access to airport lounges, either with a specific card issuer lounge or with an airline lounge (or both). These are luxury spaces to wait out a long layover while enjoying food and drinks.

“Airport lounge access and expedited airport security can help save your sanity and several hundreds of dollars, even if you only use them a few times a year,” Yarbrough says.

Check out the best credit cards for airport lounge access.

Travel insurance

If you experience flight delays, lose a checked bag or have another travel mishap, credit card travel insurance can save the day. Most credit cards offer travel insurance, but the more premium the travel card, the better the coverage.

As Yarbrough puts it, “The sheer peace of mind and potential value in an emergency can make benefits like trip cancellation and interruption insurance, trip delay insurance [and] baggage reimbursement worth their weight in gold.”

Global Entry or TSA PreCheck credit

Global Entry is a trusted traveler program that speeds up the re-entry process from another country back to the U.S. TSA PreCheck lets you access a dedicated security lane at participating U.S. airports that’s faster and lets you keep your shoes and a light jacket on.

It costs $100 to apply for Global Entry and up to $85 to apply for TSA PreCheck. Many travel cards will reimburse your application fee with a statement credit, including:

Annual statement credit

Some travel cards carry hefty fees — $695 and even higher. In return, you’ll get a slew of benefits to justify the annual fee, like annual travel statement credits. Some of these credits are valid for a wide range of travel purchases. Others are limited to specific airlines and hotels.

“Annual travel credits are among the best perks on the market,” Yarbrough says. He’s in favor of general use, not brand-specific, travel credits.

“Credits that don’t require you to use a specific airline or hotel brand can offer more personal value since they won’t require you to adjust your travel plans,” he explains.

Annual free hotel night

You might be able to get a free night’s stay at a hotel with your travel card.

Companion pass

Some co-branded travel rewards cards let you earn a companion pass — for use for a friend or family member who can fly with you for free — if you meet a certain spending threshold.

Elite status

Having elite status with an airline or hotel can make your travels more comfortable and save you cash. While elite status is usually reserved for frequent travelers, several loyalty programs issue it to co-branded cardholders. Some of these cards even let you earn additional status via credit card spending.

Cardholders who benefit most from travel cards

Travel rewards cards are ideal for people who have good credit and pay off their balance every month. These cards tend to have high interest rates, and accruing interest will outweigh the value of your points or miles.

In addition, “A travel card would be a perfect fit for frequent flyers and hotel guests, business travelers and students studying abroad,” Yarbrough says. “Depending on the individual card features, a travel card could also provide plenty of value if you drive, commute or use rideshares a lot.

“It’s also important to consider whether a travel card might eventually be valuable to you — even if you’re not traveling much at the moment,” he continues.

Here’s a look at the cardholders who benefit most from travel rewards cards:

Frequent travelers

People who travel often will have the chance to maximize travel card perks.

Consider the co-branded Hilton Aspire Card. It carries a $450 annual fee but comes with benefits like an annual free night, top-tier Diamond status and room upgrades. A frequent Hilton traveler would have no problem justifying the annual fee.

Those who don’t travel often may not redeem the free night or tap into benefits. In fact, loyalty programs often count on this to stay profitable.

Aspirational travelers

If you’ve ever scrolled through Instagram travel posts and thought, “I want that experience — without the price tag,” then a travel credit card may be a good fit for you. You can redeem points for a dream destination, first-class flight or five-star hotel stay.

Small business owners

Small business expenses can earn a stash of points with the right credit card. For example, the American Express® Business Gold Card earns 4X points on your top two of six eligible bonus categories each month (up to $150,000 per year, then 1X after), plus 3X on eligible travel purchases. But you’d want to earn enough to justify the $375 annual fee.

On the other hand, the Blue Business® Plus Credit Card from American Express has no annual fee but earns 2X points on all spending (up to $50,000 per year, then 1X after). By maxing out the 2X bonus, you’d earn 100,000 points a year.

Big spenders

Some travel cards offer annual spending bonuses for big spenders. Rewards could include airline and hotel elite status, free hotel nights and companion passes.

These perks can be worth hundreds, even thousands, of dollars in value every year. But juggling large amounts of spending across multiple travel cards can be challenging. You don’t want to accrue interest on a balance or miss a payment.

Is a travel rewards card right for you?

A travel rewards card is probably right for you if you want to — you guessed it — use points for travel.

While some cardholders can benefit from travel cards, others might be better off with one of the best cash back cards.

Here are some factors for deciding whether a travel card is worth it for you.

Factors to consider

-

Are you looking to book aspirational travel, or do you prefer roadtripping and sleeping in a tent? The annual fee, luxury perks and redemption options of a travel card tend to be best for high-end travel.

-

“You can maximize the rewards you earn by picking at least one card that earns more than 1X points or miles on some of your biggest purchases,” Yarbrough explains. Just make sure the value of your rewards is higher than the annual fee, and that you can pay off the card balance each month. If you’re only putting a few hundred dollars a month on your travel card, then a cash back card or a no-annual-fee card might be a better fit.

-

You’ll usually get more bang for your buck (or rewards) by booking with one of the card issuer’s transfer partners for more than one cent per point or mile.

“For my money, Chase Ultimate Rewards cards offer the best travel perks, rewards opportunities, redemption options and transfer partners,” Yarbrough says. “The Chase Sapphire cards can redeem points at up to 1.5 cents apiece toward Ultimate Rewards travel and at 1 cent each for cash back and most other options.”

-

Just because a card is loaded with perks doesn’t mean it’s the best option out there. For example, the Amex Platinum Card comes with luxury benefits for a $695 fee. But if you don’t maximize the benefits, you may be better off with the American Express Green Card®* for a $150 annual fee or even a card with no annual fee.

The bottom line

If you’re earning enough points with a travel rewards card and using that elite status, free night or companion pass, then it’s probably worth paying an annual fee. But if a travel card is collecting dust in your wallet or you’re overspending to earn incentives, it may not be worth it.

“A large part of getting the most value from a travel card comes down to maximizing your rewards’ value,” says Yarbrough. Analyzing your spending habits and travel plans will help you decide whether a travel card is right for you.

*The information about the United℠ Explorer Card, Hilton Honors American Express Aspire Credit Card*, The World of Hyatt Credit Card, the IHG® One Rewards Premier Credit Card, AAdvantage® Aviator® Red World Elite Mastercard®, British Airways Visa Signature® Card and American Express Green Card® has been collected independently by Bankrate. The card details have not been reviewed or approved by the card issuers.

Read the full article here