Key takeaways

- If you regularly shop at Amazon.com or Whole Foods, the Prime Visa deserves your attention, thanks to its exceptionally high rewards rate.

- Prime Visa cardholders can use their rewards points to offset Amazon.com purchases and may also qualify for bonus rewards earning options, such as Amazon’s Prime Card Bonus deals.

- Before applying for the card, make sure its bonus categories and redemption choices make sense for your spending habits.

My partner and I have quite a few different rewards credit cards for personal and business use, and our main goal is earning points that can be pooled for transfers to airlines and hotels. However, we also have a few cash back credit cards thrown into the mix, mostly because cards we choose offer much higher rewards rates for categories we spend in often.

The Amazon Prime Visa is one of those cards, and we chose to sign up because it offers 5 percent cash back on Amazon and Whole Foods purchases along with bonus rewards on other types of spending. This card gives us the opportunity to earn generous cash back or other rewards for our online shopping, and we also get the consumer protections that come with paying with plastic (including zero fraud liability for fraudulent purchases).

The Prime Visa* requires an Amazon Prime membership, but we had that already. Here’s an overview of the reasons my husband and I signed up for this card a few years ago, steps we take to maximize cash back rewards and other ways we benefit from having the Prime Visa in our card lineup.

Earn 5% back when you shop online with the Prime Visa

Many cash back credit cards offer up to 2 percent back on everything you buy, but that doesn’t come close to this card’s rate for purchases with the online retailer. In fact, cardholders with the Prime Visa and a qualifying Prime membership earn unlimited 5 percent back on online purchases with Amazon.com and Amazon Fresh, plus the same rate online and in-store at Whole Foods Market.

To see these benefits in action, let’s say you spend $300 per month on household essentials and other purchases with Amazon.com, plus another $800 on online food delivery through Whole Foods or Amazon Fresh. In this case, you could earn $55 per month in cash back on those purchases, or $660 in cash back over the course of 12 months.

And remember, that’s on top of the rewards you can earn for other spending. If you use this card for daily purchases and bills, you’ll also rack up 2 percent back at restaurants, gas stations and local transit and commuting expenses, as well as 1 percent back on everything else you buy.

How does this pay off in my household? While we try to do most of our shopping in person at brick-and-mortar stores, we still rely on Amazon for items we don’t have time to shop for. In the last few months, we have used the online retailer to order things like shampoo and conditioner, dishwasher tabs and new socks for my husband.

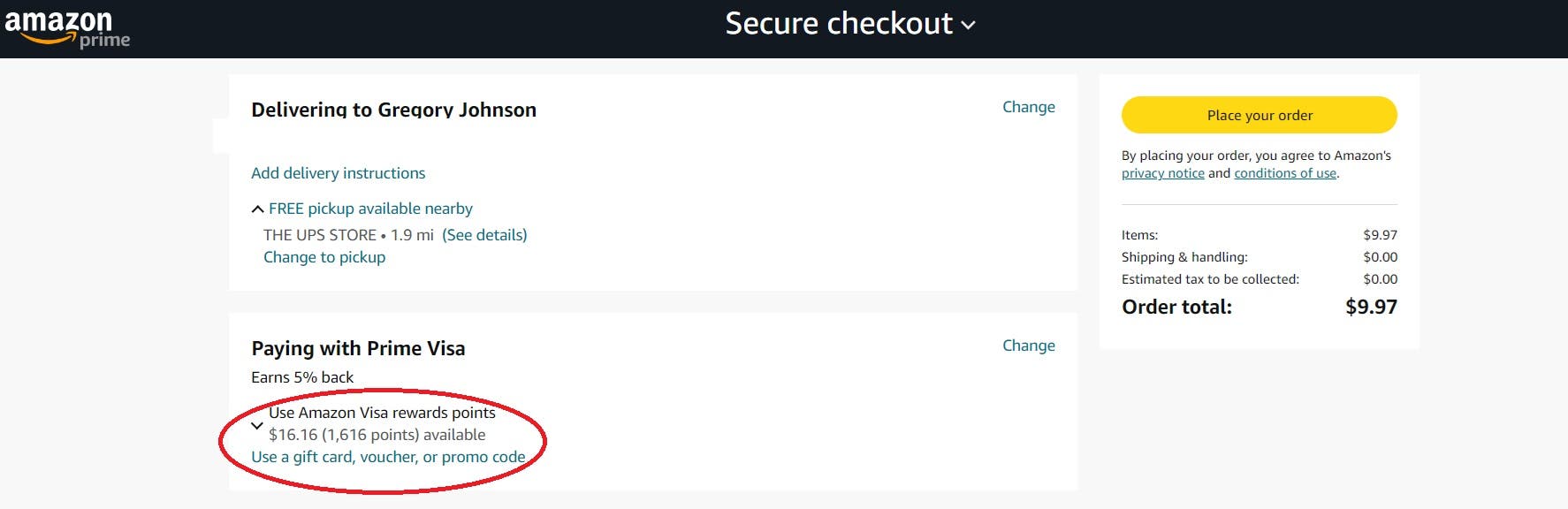

EXPAND

As you can see in the screenshot above, earning 5 percent cash back for these purchases can add up fast. You probably also notice that we don’t really use this card for any other purchases outside of its 5 percent cash back categories. For all other types of spending, including groceries, gas and travel, we rely on other rewards credit cards.

Select purchases with the online retailer net 10% cash back (or more)

This cash back credit card also offers a “Prime Card Bonus” that translates to 10 percent back (and potentially more) on eligible purchases through the online retailer. While the deals that qualify change all the time, they often include popular electronics, clothing, small furniture, shoes, cookware and other items you’d find on your normal shopping list.

Some of the Prime Card Bonus items available as of this writing include a 12-month Microsoft 365 Personal subscription, 3rd generation Apple AirPods, Beats Solo3 on-ear headphones and a 14-inch HP laptop with Windows 11.

There’s no annual fee and no foreign transaction fees

You won’t pay an annual fee for the Prime Visa, nor will you pay foreign transaction fees if you use it for purchases abroad.

This means the rewards you earn with online shopping are entirely yours for “free” — at least, they can be if you pay your credit card bill in full each month and avoid paying interest on purchases.

This is another reason I personally signed up for the card, and why I’m happy using it only for Amazon and Whole Foods spending. The lack of an annual fee means I can use it when I want to, but I don’t have to feel pressured to maximize its value.

Redeem your rewards for Amazon.com merchandise, cash back and more

Points earned through the Prime Visa can be redeemed in several different ways, including offsetting eligible Amazon.com purchases (some popular products like music, Kindle eBooks and video downloads may be excluded).

Alternatively, Prime Visa points can be redeemed with Chase — the card’s issuer — to claim cash back, gift cards and travel redemptions. Note that redeeming your rewards with Chase does not make them part of the Chase Ultimate Rewards program or eligible for Ultimate Rewards perks like point transfers to airlines and hotels. However, you can use your points for travel redemptions through the Chase Travel℠ portal at the normal cash back rate.

On a personal level, I just redeem my rewards for free merchandise (or a lower bill for purchases) with Amazon. It’s the easiest thing to do, and it lets me use some of my cash back for “splurge” purchases I might otherwise not pay for.

Redeeming rewards at checkout on Amazon.com is also a breeze. All you have to do is shop for items you want like normal, click on your shopping cart to check out and select the option to pay for all or part of your purchase with cash back earned from this card.

EXPAND

You can even redeem some rewards to cover all or part of a purchase while saving the rest of your cash back for something else.

The bottom line

If you shop online with Amazon.com (and, who doesn’t?), you’ll almost certainly benefit from signing up for the Prime Visa. Doing so will net you unlimited 5 percent back on millions of different products, and you can even earn 10 percent cash back (and potentially more) on eligible Prime Card Bonus specials.

Since there’s no annual fee, and applicants may qualify for a $100 (or more) Amazon.com gift card upon account approval, the Prime Visa is easily one of the best credit cards for online shopping enthusiasts everywhere.

If you’re ready to learn more about this card, check out our Prime Visa card review and benefits guide. Doing so can help you decide if this card is worth it, or if you should consider other cash back credit cards instead.

*The information about the Amazon Prime Visa has been collected independently by Bankrate. The card details have not been reviewed or approved by the issuer.

Read the full article here