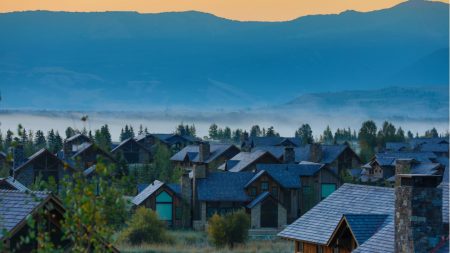

Morsa Images/Getty Images

With home prices setting one record after another, it’s a terrible time to be a first-time buyer. New data from the National Association of Realtors (NAR) shows just how challenging today’s housing market is.

High prices and low inventory

High home prices are creating hurdles for would-be homeowners. First-time homebuyers in the past year fell to a record low of just 24 percent of all buyers, according to NAR’s 2024 Profile of Home Buyers and Sellers, released Nov. 4. Before 2008, the share of first-time buyers hovered around 40 percent.

Meanwhile, the median age of first-time buyers has risen to 38, the highest ever, NAR says. The previous record was 36.

“We’re definitely seeing that due to decreased affordability, first-time buyers are holding off on purchasing their first home,” says Brandi Snowden, NAR’s director of member and consumer survey research.

As recently as 2010, the typical age of first-time buyers was 30. However, home prices have been soaring amid an ongoing shortage of homes, coupled with strong demand.

“We have 50 million people in this country who are between 30 and 40 — peak homebuying years. We just have this enormous cohort of people who are looking for housing,” says Michael Fratantoni, chief economist at the Mortgage Bankers Association. “We have been underbuilding, and we have been underbuilding by a lot.”

Since the Great Recession, builders have slowed the pace of housing starts. They’ve also shifted their focus away from starter homes and toward higher-priced, higher-profit new homes.

“The lack of entry-level homes is across the board, across the country,” Fratantoni says. “That is where the lack of supply is the tightest.”

Another culprit is the lock-in effect — for homeowners with 3 percent mortgage rates, moving would mean having to give up their historically cheap deals.

The result is that home prices keep hitting new records. The nationwide median sale price in September was $404,500, up 3 percent from last year and the highest September median on record, NAR says. Meanwhile, the Case-Shiller home price index hit a new high in August.

Add in other factors, such as soaring property insurance rates, and affordability has been squeezed. “There’s a lot of factors conspiring to make first-time homebuying a challenge,” says Allan Prindle, president and CEO of Power Financial Credit Union in Florida.

Trying to buy? Here’s what you can do

Millennials and younger generations value homeownership. However, they’re also hindered by affordability challenges. Blame it on the triple whammy of pandemic-elevated home prices, tight inventory and higher mortgage rates. Here are some ways for first-time homebuyers to cope with a tough market:

- Look for loans with low down payments: FHA loans, which are insured by the Federal Housing Administration, let borrowers put down just 3.5 percent with a credit score of 580 or higher. USDA loans, guaranteed by the U.S. Department of Agriculture, and VA loans, offered by the U.S. Department of Veterans Affairs, require no down payments. Meanwhile, Fannie Mae’s HomeReady mortgages and Freddie Mac’s Home Possible loans allow borrowers who make less than 80 percent of their neighborhoods’ median income to obtain a conventional loan with just 3 percent down.

- Don’t overlook down payment assistance: There are many first-time homebuyer and down payment assistance programs. Every state has these programs, and there are 2,244 such initiatives available nationally, says Rob Chrane, CEO of Down Payment Resource. However, many buyers and even real estate agents are unaware of these programs. Chrane says that while 80 percent of borrowers using FHA mortgages are eligible, just 15 percent receive down payment assistance. Mike Hutchins, president of Freddie Mac, agrees that down payment assistance is too often ignored by buyers. “There’s a myriad of programs that are offered, but they’re underutilized,” he says.

- Get creative: Many first-time buyers are turning to alternative homebuying strategies such as house-hacking and co-buying. House hacking can mean buying a duplex or triplex, living in one unit and renting out the other(s) to help cover the mortgage. Co-buying refers to purchasing a home with someone who’s not your spouse. Or, accept the reality that a single-family home with a white picket fence might be out of your reach for now, and consider a condo or townhouse as a cheaper option.

- Seek out special programs: For instance, Power Financial recently began offering loans to first-time homebuyers that include no required down payment and no private mortgage insurance. The credit union keeps its loans in its portfolio, so this program isn’t widely available, but it’s an example of how lenders are addressing the affordability crisis.

Read the full article here