Worries about inflation, high interest rates and chaotic global events have kept experts and investors queasy about the stock market and the economy overall.

All that fear and uncertainty has led to whispers about another recession or a potential stock market crash—the first since the start of the coronavirus pandemic back in 2020—while some economists are holding out hope for a “soft landing.”

While we don’t have a crystal ball that can predict when the next stock market crash will happen and what will cause it, there are things you can do to protect your investments and your finances when it does.

What Is a Stock Market Crash?

A stock market crash is a sudden, big drop in the value of stocks that’s caused by investors selling their shares quickly.

While there’s no consensus on an exact number that constitutes a crash, most economists agree that when a stock market index drops by double digits (think 20% or more) in a short period of time, then it’s safe to say the stock market is crashing.

Stock Market Crashes in History

Stock market crashes are pretty rare and usually come as a surprise to just about everyone. Some of the most notable stock market crashes include:

- The Great Depression, 1929: Over the course of a few days, the Dow Jones dropped nearly 25%. It took a little more than a decade for the economy to get back to predepression levels.

- Black Monday, 1987: The market lost 22.6% of its value in one day after higher-than-expected inflation numbers spooked investors. But within two years, it had recovered everything it had lost.

- Dot-com crash, 2000: After investors realized they poured too much money into tech companies in the late 1990s, confidence fizzled out and the dot-com bubble burst. The crash wiped out trillions of dollars from the market and led many companies to file for bankruptcy. It took until 2007 for the S&P 500 to fully recover its losses. But then . . .

- The Great Recession, 2008: The collapse of the housing market sparked a global financial crisis that caused the Dow Jones to lose more than 50% of its value in a really short time. But after a few years, the market was stronger than ever before—we were basically in a bull market (a period of strong stock market growth) from 2009 to just before the coronavirus crash.

- The coronavirus crash, 2020: In March of 2020, the COVID-19 pandemic triggered the most rapid global crash in financial history. Still, the stock market recovered ground pretty quickly, and the year closed with record highs. In fact, economists are now saying the recession from the coronavirus crash was the shortest on record—only lasting two months.1

What Causes the Stock Market to Crash?

Just like snowflakes, no two stock market crashes are alike. They are complex and there are a range of factors and causes that can lead to a stock market crash.

Market chaos, inflation, your future—work with a pro to navigate this stuff.

Here are some common factors that can lead to a crash:

- Economic factors: Recessions, high inflation, interest rate hikes

- Geopolitical events: Tensions overseas, sudden political changes, wars, natural disasters

- Global financial events: Housing bubbles, currency crisis, massive financial fraud

- Government policy shifts: Sudden changes in regulations, taxes or trade policies

- Loss of investor confidence: Negative news or rumors that send investors into a panic

But no matter what the cause is, every stock market crash leads to two things: a dramatic drop in stock prices and a boatload of panic. (You know, like Gotham City in the middle of a Batman movie).

That sudden drop drives down the value of stocks for all the other shareholders, who also start panic-selling their shares to try to cut their losses . . . which then causes stock prices to drop even further in what becomes a vicious death spiral that’s difficult to break out of.

What to Do With Your Investments During a Stock Market Crash

Let’s say you’re completely debt-free and investing in your 401(k). You’re probably feeling pretty good about it, right? But what if you wake up one morning and see the news the world’s been dreading: The stock market’s crashing! Here’s what to do next:

1. Refuse to panic.

Like we said before, panic can make the crash just as bad as the actual economic issues we’re facing. Don’t fall for it. Dealing with the unknown creates uncertainty, and uncertainty left unchecked can become fear.

So, take a deep breath and choose to stay clear-minded and think positively. It’s the best way to make logical choices about your personal finances and retirement investments during a challenging time.

2. If you’re invested, stay invested.

But the stock market’s tumbling! It’s time to sell, right? Nope. Not even close. Turn off the news and keep on keeping on (unless you need to pause your regular investing for a while because you lost your income). Remember, when you take your money out of the market, you’re basically locking in your losses.

Here’s the deal: Smart investors keep a long-term perspective. They don’t stress about how their investments have performed in the past few weeks or what they’ll do in the next couple of months. Nope!

They’re more concerned about what’ll happen five, 10 or even 20 years from now. And that helps them stay cool when everyone else is panicking like it’s Y2K all over again. Remember, history shows us the market has always bounced back. So don’t try to time the market. Focus on spending time in the market.

3. Talk to your investment professional.

When there are big shifts in the market, schedule a call with your investment professional. You need specific advice for your situation—your age, your funds, the types of retirement accounts you have, and where you are on your financial journey.

Ask your pro if you need to make any changes because of the crash. Don’t be afraid to share what’s on your mind. If you’re married, make sure your spouse is on the call too. Make a plan for how you’ll move forward together.

And by the way, if you’ve been playing the investment game without a pro in your corner—don’t. Connect with an investment professional in your area.

Ramsey Solutions is a paid, non-client promoter of participating pros.

4. Think about buying the dip.

History shows the stock market doesn’t stay down forever—it recovers time and time again. In fact, over the past 100 years, every instance of market decline (except one) has been followed by a remarkable recovery the year after.

Think about it: The stock market almost always experiences significant gains after a period of decline. So what does that mean for you when the market’s down? It’s a fire sale, baby!

If you have no debt (including a paid-for mortgage) and have extra money to invest, now might be a great time to “buy the dip” by buying more mutual funds at lower prices. But keep in mind, it’s always a smart idea to discuss investment strategies with your financial advisor first. They’ll help you make sure it’s a good time to pick up more mutual funds.

5. Keep a long-term perspective.

Remember, jumping off the roller coaster hurts (like, a lot). If you’re checking your 401(k) balance every morning and watching the gloom-and-doom news segments on the economy every night, then yeah . . . you might be freaking out a little bit. But let’s turn off cable news for a minute. Take a deep breath, step back and look at the bigger picture.

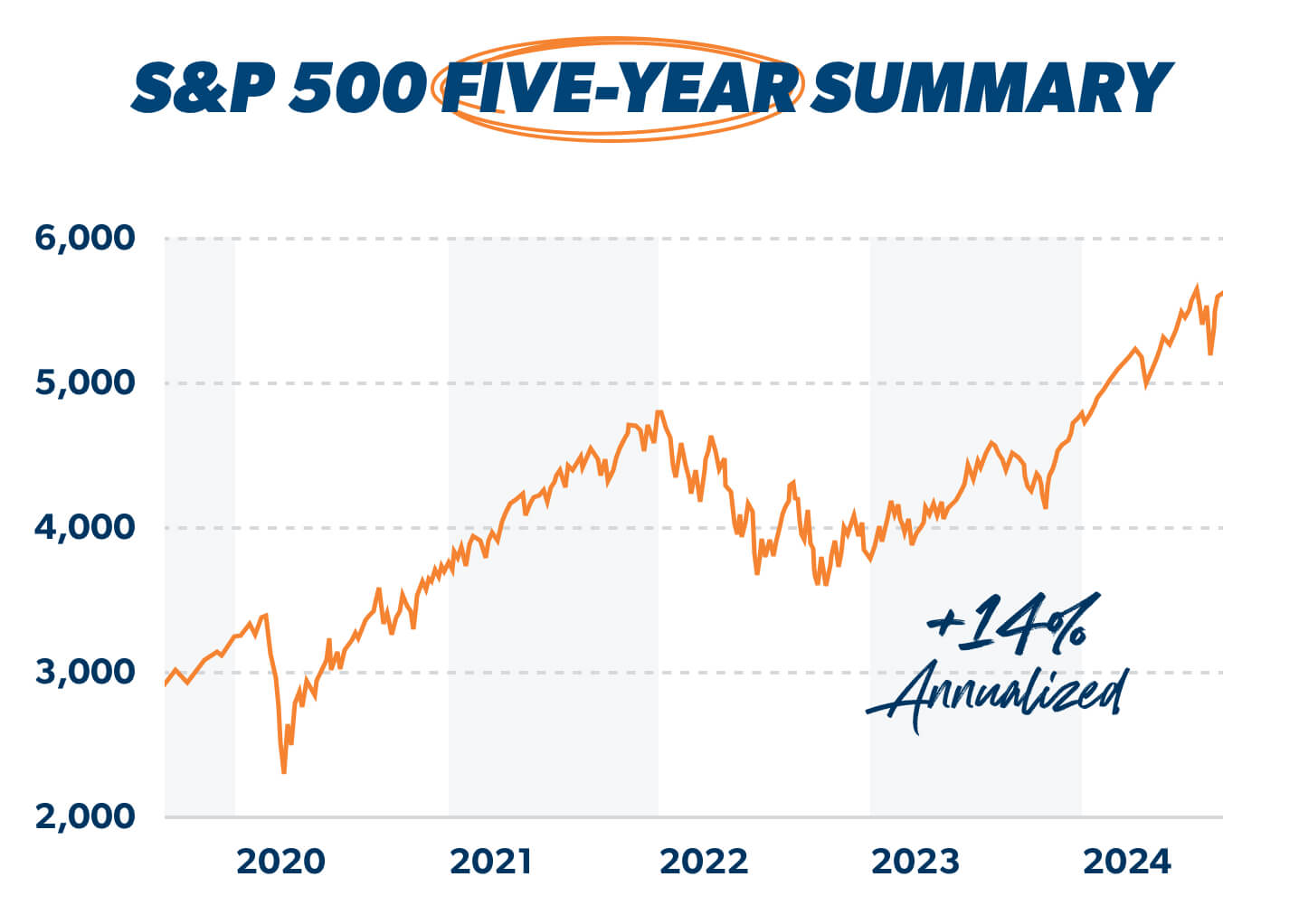

Savvy investors see that over the past 12 months (from late August 2023 to late August 2024), the S&P 500 is up over 27%. And if you pull back even further, you’ll see the stock market is still up with a 14% annualized return over the past five years.2

Here’s the lesson: When it comes to investing, keeping a proper perspective is the key. The only folks who get hurt on a roller coaster are the ones who jump off before the ride is over—so don’t jump off!

What to Do at Home During a Stock Market Crash

If the market does crash again and we find ourselves in a true recession, remind yourself that you lived through tough economic times just a few years ago. Focus on what you can control: your attitude, your outlook and your actions. Here are three huge things you can do at home to help ease economic lows:

1. Cut back on everything.

If you lose your job in the middle of an economic downturn, that means it’s time to cut out all unnecessary spending of any type.

Cancel your gym membership and avoid going on an online shopping spree! Meal plan to save money. Use up the food you have in your pantry and freezer before you even think about eating out at a restaurant.

Focus on covering your Four Walls before spending money on anything else:

- Food

- Utilities

- Shelter

- Transportation

2. Follow the proven plan.

Let’s talk about the Baby Steps for a minute. The Baby Steps have helped millions of people pay off debt and build wealth. It’s a proven financial plan that works. But in order for the Baby Steps to work, you need to understand which step you’re on and then stick to following the steps in order—even if the stock market is crashing.

If your income is stable, keep right on working the Baby Steps like you were. If you’re in debt, stay focused and don’t pause your debt snowball. That means keep on paying off your debts in order from the smallest balance to the largest balance until you’re debt-free!

What if you don’t have any consumer debt? That’s great! First, make sure you have a fully funded emergency fund of 3–6 months of expenses saved up. Once you have enough money in the bank, then you can start investing for retirement, saving up for your children’s college fund, and paying off your home early.

If at any point you’ve lost your income, hit the pause button on the Baby Steps. Focus on piling up as much cash as you can. You can pause paying extra toward debt right now. As much as that stinks, don’t worry—it’s not forever. When the tough time passes—and it will—then you can start back up and pay extra on your debt.

3. Stay Calm.

You’ve got to choose to be patient and think long term here. No matter what’s in store, remind yourself of the things you know to be true. You care about your family, your dreams and your future—so make your investment decisions with those things in mind. You’ll do a much better job of that if you stay positive and focus on the factors you can control.

Is the Stock Marketing Crashing?

No, as of right now, the market isn’t crashing. So, take a deep breath—the sky isn’t falling.

On August 5, 2024, investors experienced one of the largest single-day market drops in several years as stock markets around the world tumbled and the three major market indexes in the U.S.—the S&P 500, Dow Jones and Nasdaq—all fell by more than 2.5%.3 The plunge was sparked by growing fears of an economic downturn after a slowdown in hiring and consumer spending.

But then the stock market began to rally and recover the very next day, and by the end of the week, the S&P 500 had nearly regained all its value from its Monday losses.

And let’s take a step back and look at the bigger picture for some perspective. Toward the end of August 2024, the S&P 500 and Nasdaq were both up about 18% since the beginning of the year.4,5 Even the Dow Jones, which is full of risky tech stocks and was hit hardest by the market’s latest hiccup, was up more than 9% year-to-date.6 Nice!

This article provides general guidelines about investing topics. Your situation may be unique. To discuss a plan for your situation, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.

Read the full article here