Key takeaways

- Mobile banking usage continues to surge, with 86 percent of consumers using their banking app weekly in 2025, up from 78 percent in previous years.

- Advanced mobile banking features now include AI-powered financial insights, enhanced biometric security, real-time fraud detection, integrated investment management and personalized financial wellness tools.

- When choosing a mobile banking app, focus on security features, user experience, transaction capabilities, financial management tools and customer support options..

If you still think mobile banking apps are primarily for checking balances and depositing checks, it’s time for an update. Today’s best bank apps offer features that can fundamentally transform how you manage your finances.

Here’s what you need to know about what you can get from a mobile bank app today, and what to expect next.

Mobile banking statistics

- 86 percent of consumers now use their mobile banking app weekly, up from 78 percent in previous years. (Chase)

- 55 percent of consumers report that using a mobile device is their top option for managing their bank accounts. (American Bankers Association)

- 64 percent of Gen Zers (64 percent) and 68 percent of Millennials use mobile banking apps most often (American Bankers Association)

- Over the past decade, the use of mobile banking as the primary method of account access increased almost ninefold. (FDIC)

- The use of bank tellers as the primary method of account access — which has been on the decline — is more prevalent among lower-income and less-educated households. (FDIC)

Most important mobile banking features

Security and authentification

Mobile banking security features have become significantly more sophisticated, incorporating multiple layers of protection to safeguard users’ financial data and transactions:

-

Biometric authentication has evolved to include fingerprint or facial recognition, ensuring only authorized users can access their accounts. This adds a more robust layer of protection against unauthorized access.

-

Real-time fraud protection has become more proactive and user-controlled. Many banks also offer AI-powered fraud detection that identifies unusual patterns and potential threats before transactions are even completed. Some may offer customizable security alerts that allow users to set notification preferences for different transaction types and amounts.

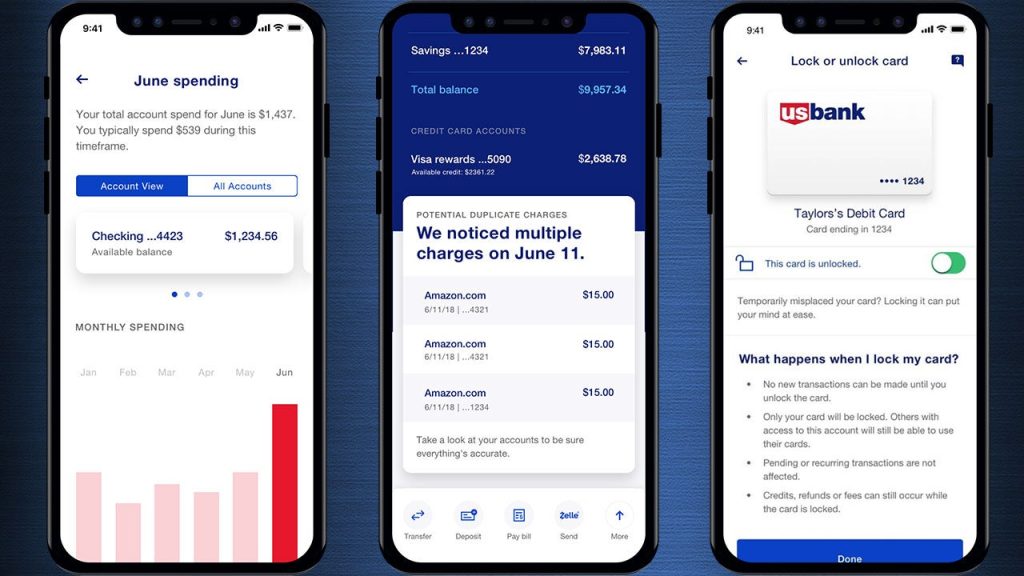

- Card and account control features have expanded to give users more granular control. Traditional methods of handling lost or stolen debit cards often involve a cumbersome process of calling the bank and waiting on hold. With mobile banking apps, users can instantly freeze or unfreeze their cards with a few taps. Users can also set transaction-specific limits, or spending caps by merchant category, transaction type or time period.

The card lock feature can be especially useful for parents who want to give their children some financial control. In case their child loses the debit card, parents can quickly lock it to prevent any misuse.

And data privacy controls and transparency are also becoming critical in mobile banking. For example, with the Bank of America app, customers can see which third parties have access to their data in the Security Center tab.

Greater transparency around how their data is stored and used can allow customers to look out for anything suspicious, and it can build trust between customers and their banks.

Learn more: Bankrate’s guide to mobile banking security best practices

Personal finance management tools

Many mobile banking apps today have evolved into complete financial management platforms, offering tools that were once available only through specialized budgeting software.

In Bankrate’s recent emergency savings report, it was found that only 41 percent of respondents would cover an emergency expense of $1,000 or more with savings. Many consumers are struggling to stay on top of their finances and avoid going into more debt.

Banks are increasingly building features to help Americans save more and understand their spending habits:

- AI-powered financial insights offer deeper analysis of spending patterns. These algorithms come with predictive tools that can analyze spending patterns and forecast upcoming expenses, giving users a clearer picture of their financial health.

-

Budgeting and tracking tools have become more intuitive and actionable. This includes features such as automated spending reports with customizable time periods and categories.

-

Bill management features have expanded to include bill negotiation services that help users identify opportunities to lower recurring expenses, due date monitoring with reminders that adjust based on account balance and recurring payment change alerts that flag when subscription costs increase.

For example, Huntington Bank launched a digital banking feature called Heads Up that predicts what a customer can afford to spend, when a merchant mistakenly double charges your card and more. Bank of America’s virtual assistant, Erica, now flags customers when a recurring charge or membership fee increases.

Digital wallet integration integrations

Digital wallets are increasingly becoming a norm as more retailers adopt cashless payment methods. According to a recent survey from Banked, almost 60 percent of consumers have used a digital wallet in the past month.

Mobile wallet features now extend beyond basic transactions to allow users to control multiple digital payment options from one interface, earn rewards on their transactions or use a virtual card for secure online purchases with temporary card numbers.

Some common examples of digital wallets include:

- Apple Pay: Available for Apple devices, Apple Pay allows users to make contactless payments within apps, stores or online by linking credit or debit cards.

- Google Pay: Similarly, Google Pay allows for contactless payments, but it’s compatible with Android devices and can be integrated with Google services.

- Zelle: Zelle is included in over 2,000 banks’ mobile apps as a way for individuals to send money to one another, directly from bank account to bank account. Check out our guide to using Zelle.

- PayPal: PayPal allows users to link bank accounts, credit/debit cards and even store money within a PayPal account. It supports online payments, money transfers and serves as a payment option for many online stores.

Read more: A beginner’s guide to digital wallets

While many popular digital wallets aren’t directly provided by banks, banks can make digital wallets more accessible for consumers by making their bank accounts compatible with digital wallets or even integrating third-party services into mobile banking apps.

While digital wallets make it a lot easier to pay for things, they also potentially make it easier to get scammed. In many cases, you only need a phone number or email to verify who you’re sending money to, so make sure you only send money and make payments to trusted recipients.

Automated savings features

According to Bankrate’s emergency savings report, 66 percent of people are worried they wouldn’t be able to cover one month of living expenses with their savings if they lost their primary source of income.

A number of banks are now offering mobile tools that can help you save through automated savings features, designed to remove the need for users to actively manage their savings. These tools automatically transfer money from one deposit account to another — typically from checking into savings — based on pre-set rules or algorithms.

Ally Bank’s app, for example, has a Surprise Savings feature that analyzes your checking account and spending history and automatically transfers a specified amount that it deems safe-to-save into a savings account.

Other banking apps, such as Varo Bank, boost savings by rounding up change from transactions and moving that amount into a savings account. Varo’s app also allows customers to choose a percentage of their direct deposit to be moved into their savings account each month.

Some banks are also using gamification to encourage users to save more consistently. These challenges often include setting specific savings goals, such as saving a certain amount by a set date, and rewarding users with badges, process tracking and even cash or APY incentives once they reach those milestones.

LendingClub Bank’s LevelUp Savings account serves as an example, rewarding savers with a substantially higher APY on statement cycles when they deposit at least $250 into the account.

Read more: 5 mobile bank apps that help you save money

Rewards and loyalty programs

Banking apps have evolved to help users maximize the value they receive for using their debit and credit cards.

Bank of America, for example, now offers a whole platform within its mobile app dedicated to cash back rewards called BankAmeriDeals. In the app, users can browse through all the stores and deals that are eligible for cash back rewards when they pay with a BofA debit or credit card.

That makes it easy for customers to quickly look at what rewards they’re eligible for when they’re already out and about shopping, so they can maximize their cash back. The app also lets users view all of the cash back rewards they’ve earned.

Other banks may offer points that are earned when you spend on certain purchases, which can be redeemed in a mobile app. U.S. Bank is one bank that’s made it easy for customers to redeem points whenever and wherever they like. Customers simply open the bank’s mobile app and can navigate to a rewards tab, where points can be redeemed for credit, merchandise, gift cards, travel and more.

What’s next in mobile banking?

Expect your mobile banking app to only get better at helping you handle your money as banks form new partnerships with fintechs and make even more improvements to their apps.

J.D. Power’s most recent U.S. Banking Mobile App Satisfaction study found that peer-to-peer payments and virtual assistance gained traction with younger customers. Still, the study found that there is a great deal of variability among apps when it comes to personal finance management.

Another noticeable gap in mobile banking is that it’s not accessible to everyone. The FDIC’s How America Banks survey found that households with higher incomes, as well as those with higher education credentials, are more likely to use mobile banking. Banking technology may evolve to address the needs of those who don’t have as much income or access to mobile banking tools.

It’s a vast playing field out there — every bank’s app offers its own variation of features. A bank’s mobile app features can influence where someone decides to bank, since these apps have become closely tied to helping you save and managing your money.

How to choose the best mobile banking app

When choosing the best mobile banking app, it’s important to consider your personal financial needs and preferences.

As a start, search for an app that offers the core banking features you need, like the ability to transfer funds and mobile check deposit.

Security features should also be your primary consideration. Look for banks that offer multiple authentication options, including biometrics. Verify the bank’s encryption standards and data protection policies and check if the app offers customizable security settings and alerts.

From there, consider other factors that are important to you:

- User experience and interface

- Transaction options and limits

- Financial management tools

- Customer support options

“A mobile banking app ultimately is akin to having a real-time view of your account,” said Mark Hamrick, senior economic analyst at Bankrate. “Think of the app as part of the range of services and benefits that the financial firm provides. Some firms do a better job than others with their apps. Ask yourself, does the app do what you need it to do? Does it provide you with the functionality that you desire? This could include real-time alerts and the ability to get a quick look at transactions, balances and payments.”

Bottom line

The best mobile banking apps offer far more than basic account access — they provide features that can help improve your financial health through advanced security, personalized insights and automated tools.

When picking a mobile banking app, prioritize features that align with your specific financial goals and habits. If building savings is your primary concern, focus on apps with goal-setting and automation tools. If security is most important, look for multi-layered authentication options and fraud protection.

Read the full article here