Social distancing, remote learning, stimulus payments—the COVID-19 pandemic introduced us all to lots of new concepts.

And while the 6-foot rule has gone out the window (thank goodness!), stimulus checks have hung around. But instead of a stimulus for pandemic relief, state politicians are now cutting stimulus checks to help ease the pain of record-high inflation and gas prices. And there’s even talk of a federal inflation stimulus check.

So, is more stimulus money coming your way? Let’s take a look.

Stimulus Update: Will There Be a Stimulus Check for Inflation?

Hey, we’ve all felt the pain of high prices on gas, groceries and just about everything else. To combat inflation, nearly 20 states have decided to give out inflation stimulus checks.

Each state has different guidelines for its inflation stimulus plans. Some states are offering tax rebates while others are sending direct payments that range from $50 up to more than $1,000. (Spoiler alert: It’s California that’s sending out those big checks.)

Congress is also considering sending out a $100 gas rebate check to everyone (regardless of whether you drive or not) in every month the national average gas price is $4 or more. But so far, the Gas Rebate Act of 2022 hasn’t picked up much speed—and neither has the idea for a federal gas tax holiday.

Will There Be a Recession Stimulus Check?

Well, in case you missed the news, the U.S. economy is in a mild recession (emphasis on mild). So, will Uncle Sam start sending out recession stimulus checks? The answer is, maybe one day—but not now.

It might surprise you, but stimulus checks were actually a thing way before COVID! The government sent out stimulus checks during the 2001 and 2008 recessions to try to boost consumer spending. Most people got $300—which is nowhere close to the three big stimulus checks people got during the pandemic.

The idea behind a stimulus check is to help people who are struggling to pay their bills and kick-start consumer spending. But that really wouldn’t make sense right now, because giving consumers more money to spend would boost inflation—and that’s already out of control.

Congress currently isn’t considering any recession stimulus check bills, but you never know what those guys (and gals) are up to.

Will There Be a Fourth Stimulus Check From the Government?

Some lawmakers pushed for a fourth stimulus check to help Americans who were struggling to rebuild after COVID-19 and its economic impact. But that stimulus never happened.

With the economy and jobs both on the upswing after the country started to reopen, another federal stimulus check didn’t seem necessary. But some states took matters into their own hands and sent out a fourth stimulus check to their residents.

Why Are States Giving Out a Fourth Stimulus Check?

It all started back when the American Rescue Plan rolled out. States were given $195 billion to help fund their own local economic recovery at the state level.1 But they don’t have forever to spend this money—states have to figure out what to use it on by the end of 2024, and then they have until the end of 2026 to spend all that cash.2 That might sound like forever, but the clock is ticking here.

Want to earn extra cash but don’t know where to start? Take this quiz to find the best side hustle options!

Some states have given out their own version of a stimulus check to everyone, and others are targeting it at specific groups like teachers. And other states? Well, they haven’t spent any of it yet.

Some states like Colorado, Maryland and New Mexico are giving stimulus checks to people who make less than a certain amount of money or who were on unemployment. So far, California is the only state to give out a wide-sweeping stimulus check.3 Other states like Florida, Georgia, Michigan, Tennessee and Texas are putting the money toward $1,000 bonuses for teachers.

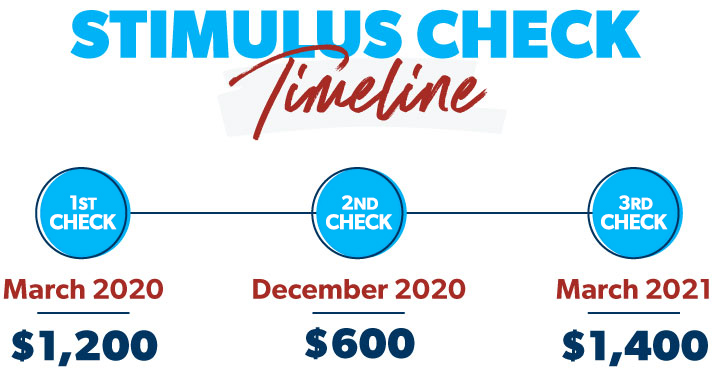

How Many Stimulus Checks Have There Been?

If you’re like most people, everything that’s happened since March 2020 is a blur—including how many stimulus checks there were and when the checks went out. Here’s a quick reminder.

First stimulus check: March 2020 – $1,200

Second stimulus check: December 2020 to January 2021 – $600

Third stimulus check: March 2021 – $1,4004

What Is a Plus-Up Payment?

A plus-up payment is basically just a bonus amount that you probably should have gotten the first time you filed your taxes. The IRS actually owes more money to some people based on their tax returns. If the IRS used your 2019 tax information to dish out your stimulus payment but your 2020 taxes show that it underpaid you—you might be in for a plus-up payment based on your income. But remember, this isn’t for everyone—only those who had a change in income or dependents (like having a baby) would qualify for more stimulus money.

When Was the Third Stimulus Check Approved?

By now, you’ve heard the history of how a third stimulus check happened: Just as most Americans received their $600 second stimulus check from the U.S. Treasury during the coronavirus pandemic, President Joe Biden’s $1.9 trillion American Rescue Plan included a third stimulus payment of $1,400.

The American Rescue Plan passed first in the House and then Senate and was signed by President Biden on March 11, 2021. Lawmakers wanted the bill to go into effect before some COVID-19-related unemployment benefits expired in mid-March 2021.5 And they hit their deadline just in the nick of time.

How Much Is the Third Stimulus Check?

The third round of stimulus checks included a $1,400-per-person ($2,800-per-couple) direct payment. This amount topped off the $600 payment that most eligible folks already got as part of a previous COVID-19 relief package. Congress passed that one at the end of December 2020 for a total of $2,000 in stimulus payments per person. So, how much should you have gotten in your third stimulus check? Find out with our stimulus calculator!

The stimulus payments are one part of Biden’s much larger COVID-19 relief plan that also expanded the Child Tax Credit, extended unemployment benefits for people who lost their jobs during the COVID-19 pandemic, increased the Child and Dependent Care Credit, and provided more aid for renters and landlords.6 Yep, it’s a mouthful.

What Was the Timeline for the Third Stimulus Check?

Once the bill moved through all the hoops, eligible people started seeing their stimulus payments before March 2021 was over.7 The IRS and U.S. Treasury have been quick with delivering past stimulus checks—December 2020’s payments reached most folks by direct deposit within a week of then President Donald Trump signing the legislation.8

Who Is Eligible for the Third Stimulus Check?

For the first two stimulus payments, single taxpayers earning up to $75,000 a year and couples earning up to $150,000 a year (based on 2019 tax returns) were able to get the full amount. Parents also received stimulus payments for each dependent child under age 17.9,10

Those income limits didn’t change for the third stimulus payment even though it targeted the payments to lower income earners. Under the American Rescue Plan, payments phased out for single filers making between $75,000 and $80,000 and couples making between $150,000 and $160,000.11

Eligibility for the third stimulus check also expanded to cover any non-child dependents. That means taxpayers who supported certain eligible dependents age 17 and older might have received more money too.12

How Will You Receive the Third Stimulus Check?

Most people got their previous stimulus checks by direct deposit with the bank account on file with the IRS. Payments were automatic for anyone who filed a 2019 tax return and/or was receiving Social Security benefits. If you didn’t have direct deposit with the IRS, your payment would take a little more time and come as a check or debit card in the mail.13

What if I Haven’t Gotten My Stimulus Check Yet?

First, head over to the government’s site and sign in to your account to check on your payment status. If it shows the stimulus check was issued to you but you haven’t gotten it yet, you can run a payment trace to track it down. If the check wasn’t cashed, the IRS will reverse the payment, and you’ll be able to claim it on your taxes. You can do this through the Recovery Rebate Credit.

If the check was cashed (not by you), you’ll have to make a claim and go through a whole process to get your stimulus money. That really stinks. Sorry in advance if you fall into that category. But with any luck, they should be able to straighten things out for you.

Will You Have to Pay Back Money From a Previous Stimulus Check?

You might. Here’s why: Some people were sent stimulus checks by accident. Whoops! We know—imagine the government making a mistake, right? Here’s why you might need to send your money back:

- You make more than the income limit required to receive the stimulus money.

- You were given a check for someone who has died.

- You’re a nonresident alien.

- You don’t have a Social Security number.

- You were claimed as a dependent on someone else’s tax return.

If you know one of these applies to you, the IRS expects you to find the error and send the money back to them.14 So go ahead and be honest (and proactive). You don’t want any surprises when you go to file your taxes.

How to Return a Paper Check You Have Not Cashed or Deposited

If you’re one of those folks who has to send the money back—and you haven’t cashed or deposited your check yet—here’s what you need to do:

- Write “Void” in the endorsement section of the check, but don’t fold or staple it—don’t even put a paper clip on it.

- On a sticky note or sheet of paper, write down the reason you’re sending the check back.

- Mail the check and the explanation back to your local IRS office (which varies by state).

How to Return a Paper Check You Have Cashed or Deposited

If you have already cashed or deposited the check (or it came to you via direct deposit), here’s how you can return the money:

- Make a personal check or money order payable to “U.S. Treasury.”

- Write “2020EIP” on the payment and include either the taxpayer identification number or Social Security number of the person whose name was on the stimulus payment.

- On a sticky note or sheet of paper, write down the reason you’re sending back the check or money order.

- Mail the check or money order and the explanation to your local IRS office (which varies by state).15

What Should You Do With Your Third Stimulus Check?

Let’s be real: Three stimulus checks in a year or so is not normal. This third payment can go a long way to help you catch up on bills, pay off debt, or build up your savings. And for a lot of folks, those stimulus checks have kept food on the table. In our State of Personal Finance study, we found that 41% of people who got a stimulus check used it to pay for necessities like food and bills.

So, based on your situation, here’s where you start:

If you’re out of work or missing a paycheck, use this stimulus money to protect your Four Walls:

- Food

- Utilities

- Shelter

- Transportation

Focus on the necessities so you can have peace of mind as you keep looking for work or get your income back up. That means if you’re working the Baby Steps and you’re out of work, pause your plan for now. Pile up cash until you have a steady income again. Then you can attack your debt. There’s nothing like fighting through a financial crisis to light your fire to be debt-free as soon as possible!

On the other hand, if your job is safe and you feel like it’ll stay that way, use your stimulus money to build momentum on whatever Baby Step you’re on. Put your debt snowball into overdrive. Knock out your fully funded emergency fund (38% of people surveyed in our study saved the money). Or talk to your investment professional about giving your retirement a big boost (5% of people did this)!

No matter your situation, don’t forget to budget—it’s the best way to make your money go further. EveryDollar is our free and simple budgeting app that will help you see exactly where you need to cut back on your spending.

Focus on What Goes on at Your House—Not the White House

It’s hard not to worry as you watch billions and trillions of dollars fly out the window in Washington, D.C. And while those things matter, the truth is, you have ultimate control over your money and what choices are made in your house. You have the power to improve your money situation right now—today—without having to rely on the government.

And it all starts with a budget. Because when you make a plan for your money, you’re more likely to make progress and hit your financial goals—stimulus check or not. So, go ahead and create your budget with EveryDollar today! Take control of your future and get the hope you need.

Read the full article here