STUDY SUMMARY

- Ramsey Solutions conducted a study of more than 1,000 benefits decision-makers in companies of all sizes across the United States.

- 48% say that financial stress has a significant impact on their employees.

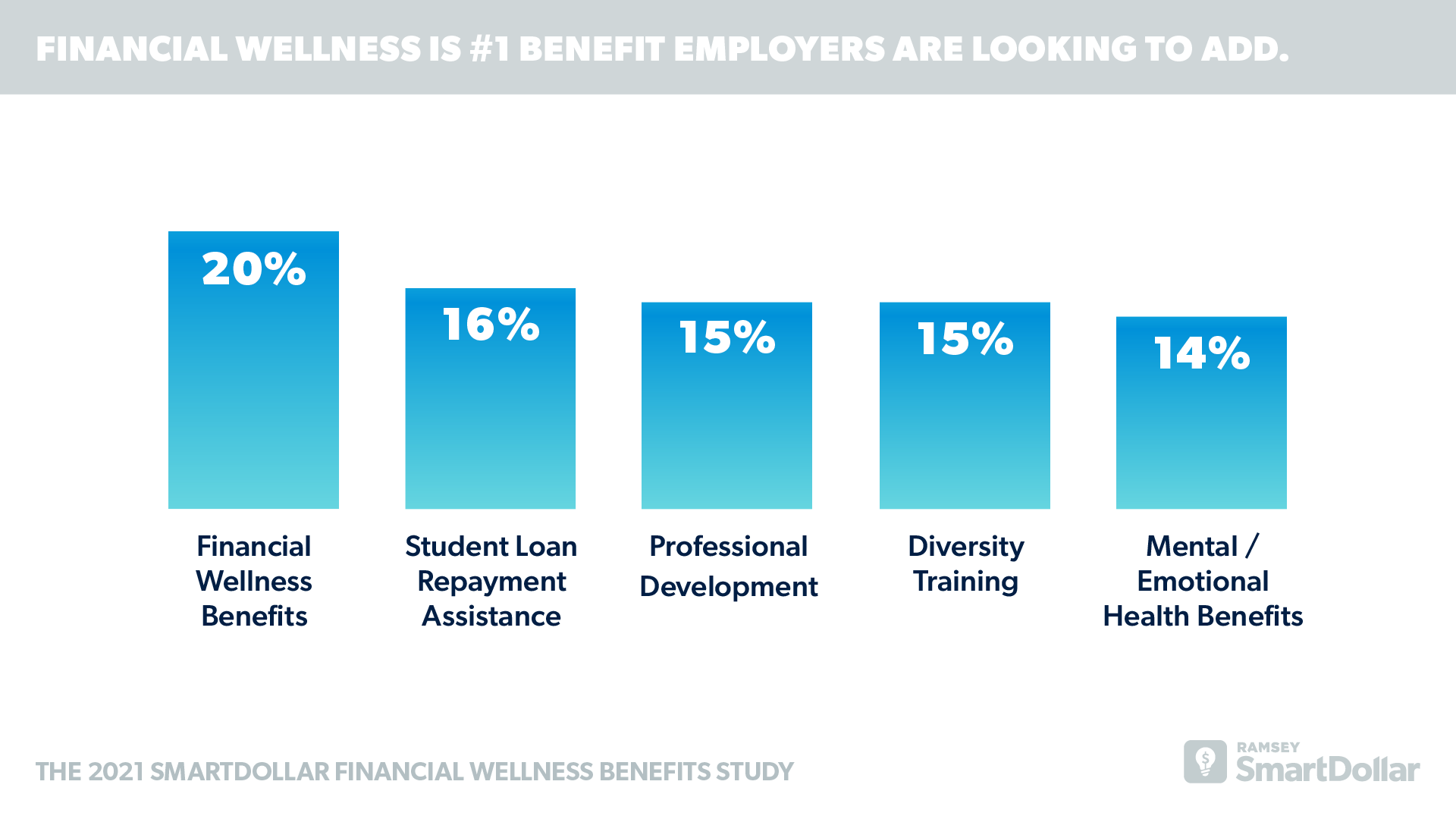

- Financial wellness is the number one benefit employers are looking to add in the next one to two years.

- 90% of those who offer a financial wellness benefit say it’s one of the most impactful benefits for their employees.

- 88% of those who offer financial wellness say their employees report less stress.

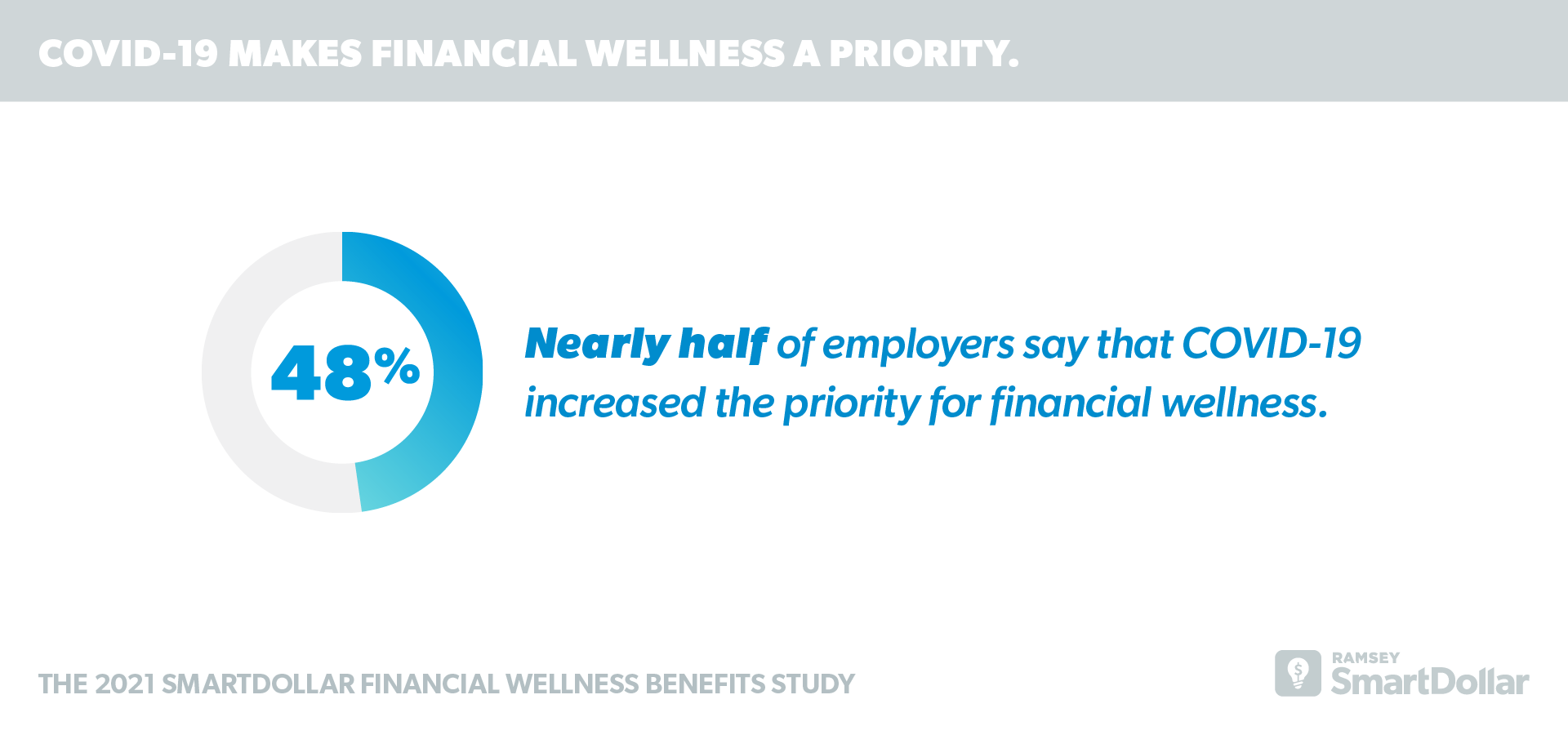

- 48% say COVID-19 increased the priority for financial wellness.

Downloads

Have questions about this study? Email us or visit our newsroom for more information.

The Need for Financial Wellness

Eight in 10 (79%) benefits decision-makers report that their employees’ personal financial problems have a negative impact on their work. In fact, nearly half (48%) say that financial stress has a significant impact on their employees. Employees need help with their money, and many employers are looking for ways to help them. For too long, employees have been living paycheck to paycheck. And it’s not just the employees themselves feeling the impacts of financial stress.

Employee Financial Stress Hurts the Bottom Line

Companies are feeling the effects of their employees’ financial issues on the bottom line. Many said they had significant concerns about high/increasing health care costs for employees (40%), high employee turnover (27%), low productivity (26%) and distracted workers (26%)—all symptoms of a team dealing with big financial problems. In addition to those bottom-line killers, employees delaying retirement due to their personal financial situation proved to be a pervasive problem. Seventy-seven percent of benefits decision-makers report that they have employees delaying retirement because of their personal financial situation.

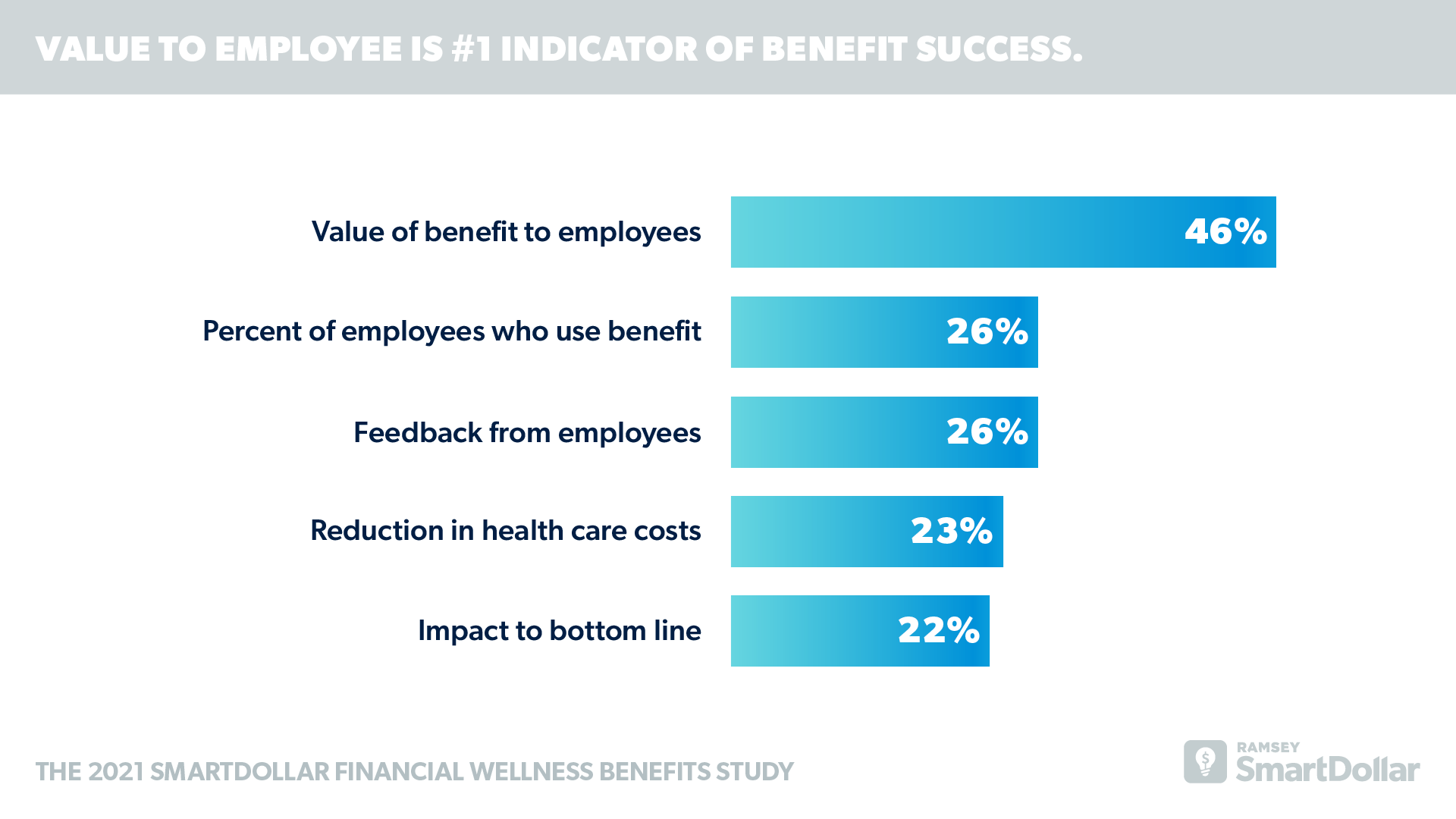

The Top Indicator of Successful Benefits

Given the impact that employees’ personal finances can have on organizations, decision-makers consider value to employees first when evaluating a benefit’s success. Almost half (46%) of employers say that value to the employee is the number one indicator of a successful business. Simply put: Benefits decision-makers want the benefits they offer to add value to their employees’ lives, so that’s how they measure their success. Other factors that contribute to a benefit’s success include usage (26%), employee feedback (26%), reduction in health care costs (23%), impact to the bottom line (22%), reduction in turnover (14%) and reduction in absenteeism (9%).

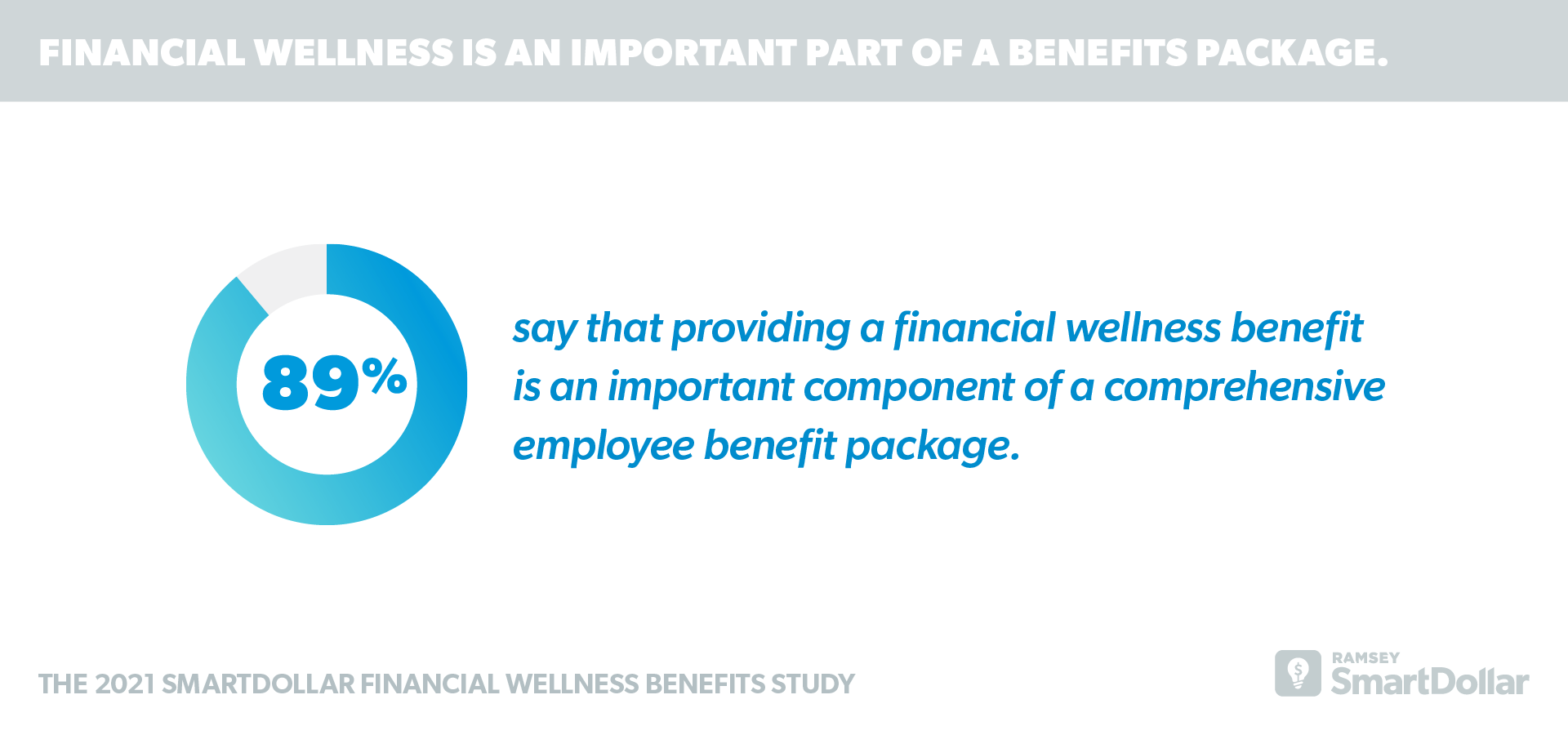

The State of Financial Wellness Benefits

With value to employees driving the measure of success, financial wellness is an essential offering. In fact, 9 in 10 benefits decision-makers say financial wellness is an important component of a comprehensive benefit package. However, currently, only about 1 in 3 benefits decision-makers are extremely familiar with financial wellness, about the same number (30%) who said they currently offer it to their employees. So, there’s plenty of growth opportunity for financial wellness benefits.

But there’s a clear trend emerging that indicates growth is happening: 27% of employers who don’t currently offer a financial wellness benefit said they are extremely likely to add it in the next one to two years. And one-third of the employers who currently offer a financial wellness benefit just added it in the last year.

Even more importantly, employer sentiment about the importance of financial wellness as a benefit is extremely positive.

The Top Benefits Considered

Benefits decision-makers are looking at a number of benefits to add in the coming years. Some of the most considered include student loan repayment assistance (16%), professional development (15%), diversity training (15%) and mental/emotional health benefits (14%). But above all, fixing employee finances is a top priority. One in 5 are considering implementing a financial wellness benefit in the next one to two years, and it’s the number one most-considered benefit.

The Impact of Financial Wellness

There’s a lot of interest and buzz around financial wellness benefits, and a ton of research shows why. The majority of companies that have a financial wellness benefit say it’s paying off in many different ways for both their employees and their organizations. From employees putting money into emergency savings (29%) and becoming debt-free (25%) to higher productivity levels (32%) and better retention rates (28%), these companies can draw a straight line from the financial health of their employees to the health of their bottom lines. Overall, among those who offer financial wellness, 90% say it’s one of the most impactful benefits to their employees.

The Impact of COVID-19 on Financial Wellness

The coronavirus pandemic had an impact on nearly every company in America. Four in 10 companies told us their businesses lost revenue from 2019 to 2020 after dealing with COVID-19 considerations. But that’s not the end of it. Those same employers saw their employees take a beating both financially and mentally as the pandemic set in. As a result of the pandemic, employers saw a significant impact on employee mental health (34%) and employee financial health (31%). That led to nearly half (48%) of them saying the pandemic had increased the priority for financial wellness as a benefit. Now more than ever, it’s critical to address employee financial stress and its impact on employers across the country.

About the Study

Ramsey Solutions conducted a study of more than 1,000 benefits decision-makers in companies of all sizes across the United States.

Survey participants recruited from a third-party B2B research panel were asked a series of 64 questions covering topics ranging from financial wellness benefits, the impact of financial wellness, barriers to financial wellness, organizational health and the impact of COVID-19. Ramsey Solutions facilitated the survey, beginning on Dec. 7, 2020, and ending on Dec. 30, 2020.

Read the full article here